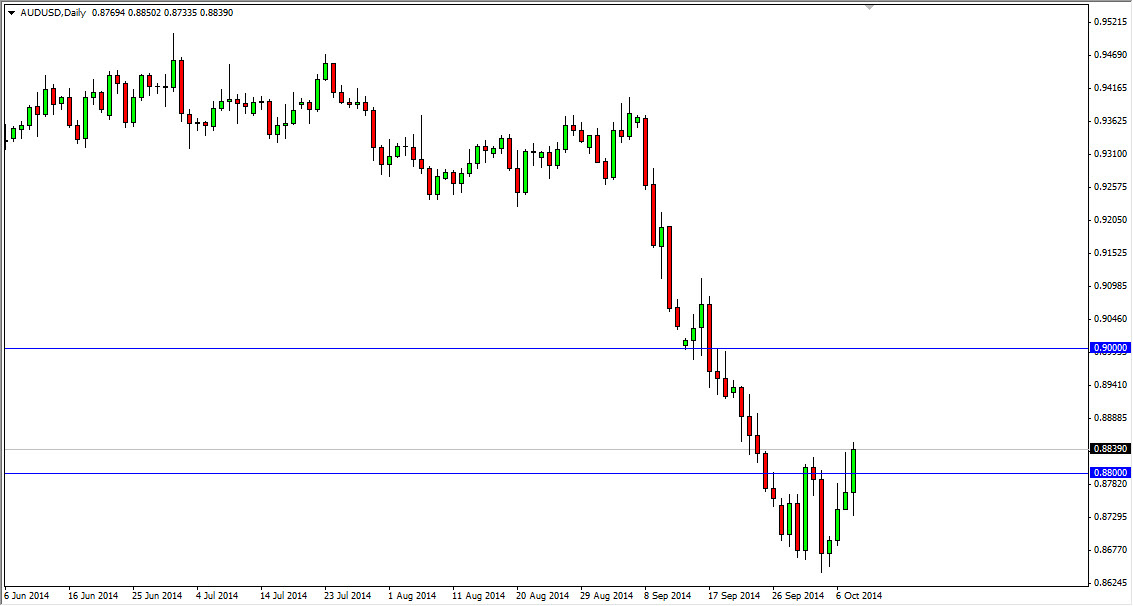

The AUD/USD pair initially fell during the course of the day on Wednesday, but ended up turning around and slicing through the 0.88 level, blowing through a significant amount of resistance. On top of that, the shooting star that had formed for the Tuesday session is now broken, and that of course is a very positive sign for the Australian dollar overall. However, I don’t think it’s quite that easy to think of this as a market that’s about to turn around.

I think that the shorter-term charts suggests that we are going to the 0.90 level, a significant amount of resistance above. So if you are shorter timeframe type of trader, then you could have the ability to start going long on a break of the highs from the Wednesday session. However, I choose not to trade such short term moves, and as a result I think that somewhere between here and the 0.90 level we should see a resistant candle.

Resistance above should offer plenty of opportunities.

I believe that there is a significant amount of resistance above, probably all the way up to the 0.91 handle. It’s not until we get above that area that we would consider buying, and any resistive candle between here and there is a selling opportunity as far as I see. Nonetheless, we are in a longer-term move to the downside, and as a result I think that this pullback will more than likely offer value as far as the US dollar is concerned.

I believe that ultimately this market will probably go looking for the 0.85 level, and if we can get below there we could go to the longer-term target of the 0.80 level, an area that was once massive resistance for decades. Because of this, it will probably act like a bit of a magnet for price, and it would make sense to revisit that area but I think it’s going to take several weeks if not months to really break down enough to start thinking about that. If we did break above the 0.91 level however, I think that we would probably test the 0.95 level. However, I highly doubt that’s about to happen.