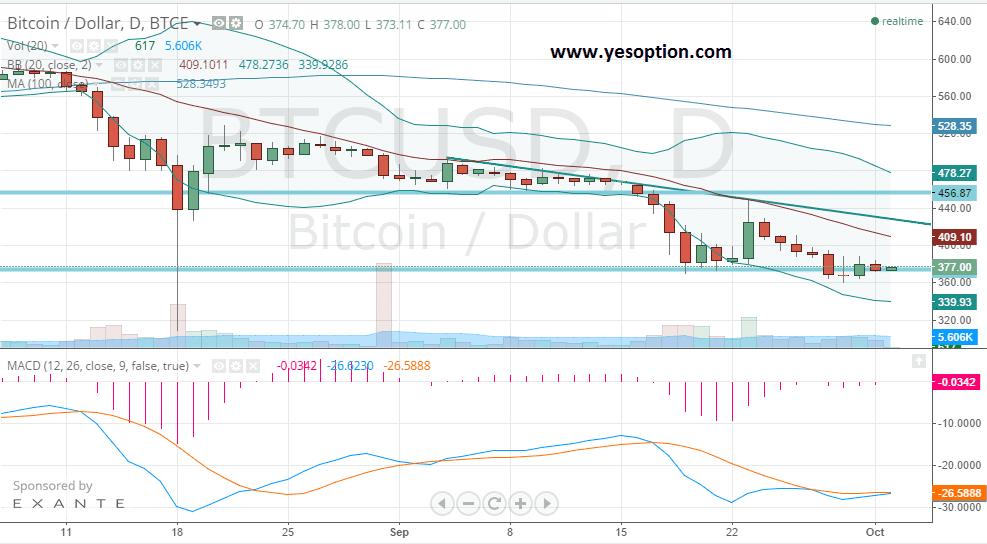

After witnessing some semblance of a pullback in Tuesdays’ session, BTC/USD gave up most of its gains yesterday on the back of relentless selling and traders taking profits. The support for the BTC/USD continues to remain near the $376 mark and the resistance on the upside continues to remain near $422.

Traders believe only a breakdown or a breakout from the aforementioned levels would provide the future course of direction for the digital currency. The BTC/USD continues to trade below its important daily moving averages. The BTC/USD is currently trading at the lower end of the trading band and continues to maintain a bearish bias. The momentum indicator for BTC/USD continues trending in bearish territory indicative of the strong negative bias.

Some pleasant news for Georgia Tech Students as it became the first university to incorporate Bitcoins as a form of payment for dinning and shopping. The university has introduced Buzzcards, which can be topped up with the digital currency and can be used to pay for a host of activities from meals to recreational activities. Georgia Tech might be the first US University to incorporate Bitcoin as a legit form of currency.

However, there are universities around the globe who have already allowed students to pay for certain transactions in Bitcoin. The University of Nicosia is one such University. This is in line with recent news wherein many Bitcoin start-ups are coming together so that they could make the digital currency available to the masses and not just a certain set of individuals. This is being seen as a huge positive and a step in the right direction.

Actionable Insight:

Short BTC/USD at current levels for an intermediate target at $300 with a stop loss at $402

Long BTC/USD if it closes above $422 for an intermediate target at $475 with a stop loss at $397.