By: Ben Myers

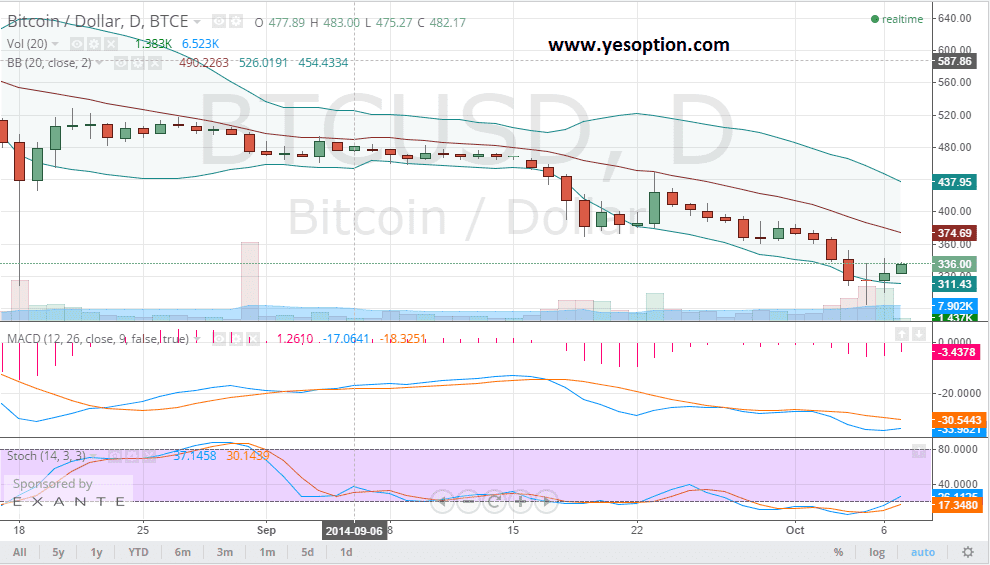

BTC/USD on the daily charts recovered from lower levels in yesterday’s trading session and continues to exhibit buying momentum in the Asian morning session. It is important to know that the BTC/USD hit an intraday low of $282 before bouncing back above the psychologically important level of $300. The BTC/USD continues to trade below its important daily moving averages. Resistance on the upside comes near the $362 level and support continues to be near the $300 level. The stochastic oscillator for the BTC/USD has given a fresh buy signal which is a bullish indictor. Similarly, the momentum indicator for the BTC/USD is showing signs of reversal which is being seen as a return of buy side momentum for the digital currency.

According to reports, Overstock.com has assembled a band of coders to create a stock exchange to issue corporate paper sidestepping traditional stock exchanges like the NYSE and the NASDAQ. The company said that it is trying to mirror the way Bitcoin works and would try to create “crypto-security” based on the crypto algorithm. This is being considered a huge game changer for the financial industry.

The founder of Overstock.com believes that just the way Bitcoin was able to revolutionize the currency market, the crypto exchange would change the way investors look at Wall Street. There were news floating around in the Bitcoin markets about market manipulation behind the sub $300 fall seen a couple of days ago. Many believe that a huge sell order was executed below the market price, which led to the huge fall on the back of volumes.

Actionable Insight:

Short BTC/USD below $300 for a short term target at $273 with a strict stop loss above $321

Long BTC/USD at current levels for a short term target of $362 with a stop loss below $300