By: Ben Myers

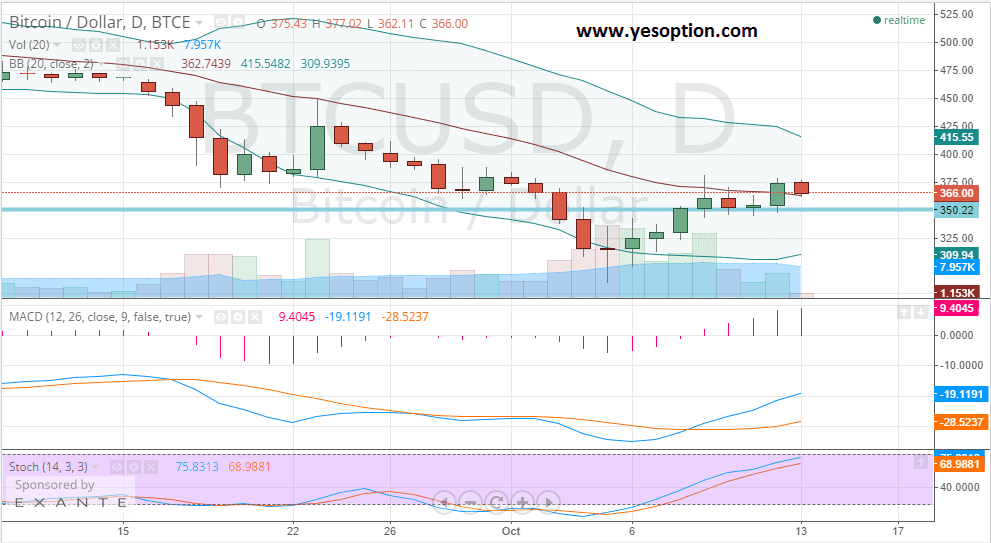

BTC/USD continued to trade in a narrow range, forming a strong support zone at $350 levels but maintaining resistance at the upper end of $385. Either traders believe only a move on a breakout or a breakdown would provide the future course of direction for the digital currency in the near term. BTC/USD continues to trade below all-important daily moving averages, which is a bearish indicator.

The stochastic oscillator for BTC/USD continues to be in a strong uptrend and is showing no signs of a reversal, which is a positive sign. The Momentum indicator continues to indicate the buying momentum present at current levels. Traders believe that post the volatile moves seen over the last couple of weeks, most weak hands have been forced out of the market and only strong buyers are currently present in the market.

Romania becomes one of the first countries to start selling Bitcoin through ATM networks with a tie up with network provider ZebraPay. The ATM would be charging 4% commission on prices and buyers would not have to submit documentation during the transaction which is being seen as a huge positive by the trader community.

As per early reports, the demand for Bitcoins using ATM machines is quiet high. In other positive news, the Ebola outbreak in the West African nation of Sierra Leone has seen an outpour of support in the form Bitcoin donations. Supporters of Bitcoin believe that the current donation drive shows the mass movement that Bitcoin can create as it breaks down the barriers of forex exchanges and is now being used to support social causes and not being used just as a financial asset.

Actionable Insight:

Short BTC/USD if it breaks below $365 with an intermediate target at $321

Long BTC/USD if it breaks above $385 with an intermediate target at $422