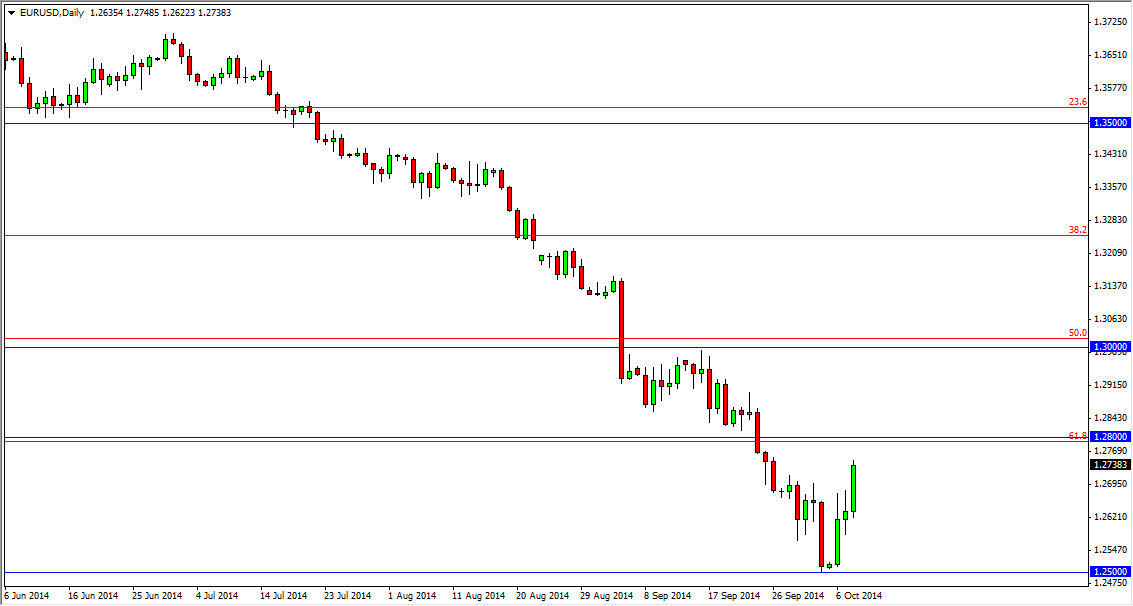

The EUR/USD pair rose during the course of the day on Wednesday, breaking above the 1.27 level. This is of course a very bullish sign, but the biggest problem I have is that we have several resistance barriers above that will more than likely turn this market around given enough time. I think the 1.28 level is the first major barrier above that could turn the market around. On top of that, it appears that the resistance runs from there all the way to the 1.30 handle, and because of that the market will more than likely find enough resistance to continue the longer-term downtrend.

On top of that, the 1.28 level was the 61.8% Fibonacci retracement level on the longer-term trend, just as the 1.30 region is the 50% Fibonacci retracement level. Both of those areas will attract a lot of attention, and it should be noted that the 1.28 level has been massively supportive in the past, so it should end up being significantly resistive now.

The Federal Reserve minutes matter not.

I know that the Federal Reserve released the minutes of its last meeting during the session on Wednesday, which of course made the US dollar little bit softer. However, one has to think that the initial knee-jerk reaction is almost never the correct one, as the actual concerns stated buying the members were based upon global slowdowns, most notably Europe. So even if we have a longer time to wait before tightening of the United States, the reality is that the Euro is the currency of the area that causes all of the issues in the first place. In my opinion, I feel that this market is just simply bouncing a little bit, which of course is natural after we have seen such a significant downtrend.

It is not until we break above the 1.30 level that I would be concerned about the downtrend, but ultimately I have trouble thinking it’s going to happen in the near term. I still believe based upon longer-term charts that we are heading down to the 1.20 level, given enough time.