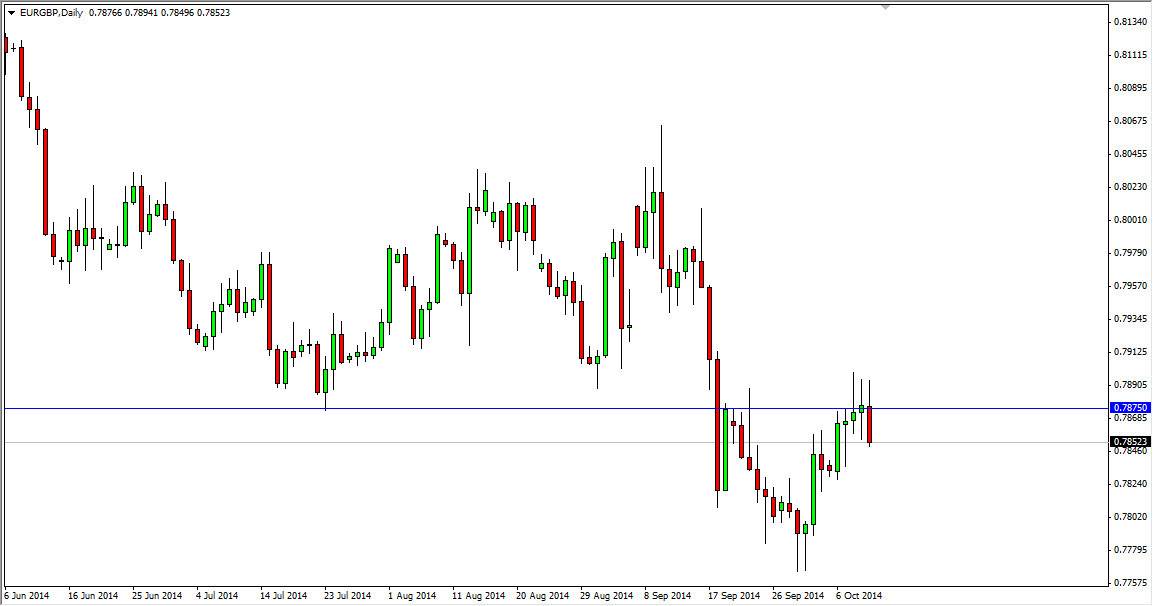

The EUR/GBP pair tried to rally during the course of the session on Friday, but as you can see it continues to respect the 0.7875 level as resistance. Because of this resistance, the market turned back around and fell all the way down to the 0.7850 level. With that, it appears of the market is breaking down a little bit, and as a result I feel that this market will continue to fall from here, perhaps continuing the previous consolidation that we have seen for some time.

The 0.7750 level below is the bottom of that consolidation, and I believe that the market is in fact going to try to reach that area given enough time. That does it mean that is going to be an easy move just that we will ultimately return. This pair tends to be very choppy to begin with, and in the state that we find the market in right now, it’s probably going to be even more choppy than usual.

Remember it’s about relative strength

Remember, when you are trading a currency pair, it’s about relative strength overall. While the British pound is a necessarily look like it’s going to be one of the strongest currencies in the world, it certainly is stronger than the Euro which is concerned about European Central Bank monetary policy being loosened, just as deflation enters the fray and becomes the concern.

The market looks as if it’s going to try to go sideways in general in this area, you have to be aware the fact that it is a longer-term support zone. With that, I think that we will continue to see short-term trading opportunities only, and we are at the top of the short-term consolidation area so I feel that the bears will take over. Ultimately though, I think that this market will find enough support below to turn things back around, but we certainly don’t have anything that looks like it’s about to happen anytime soon. A break above the 0.79 level could leave the market looking for the 0.81 handle.