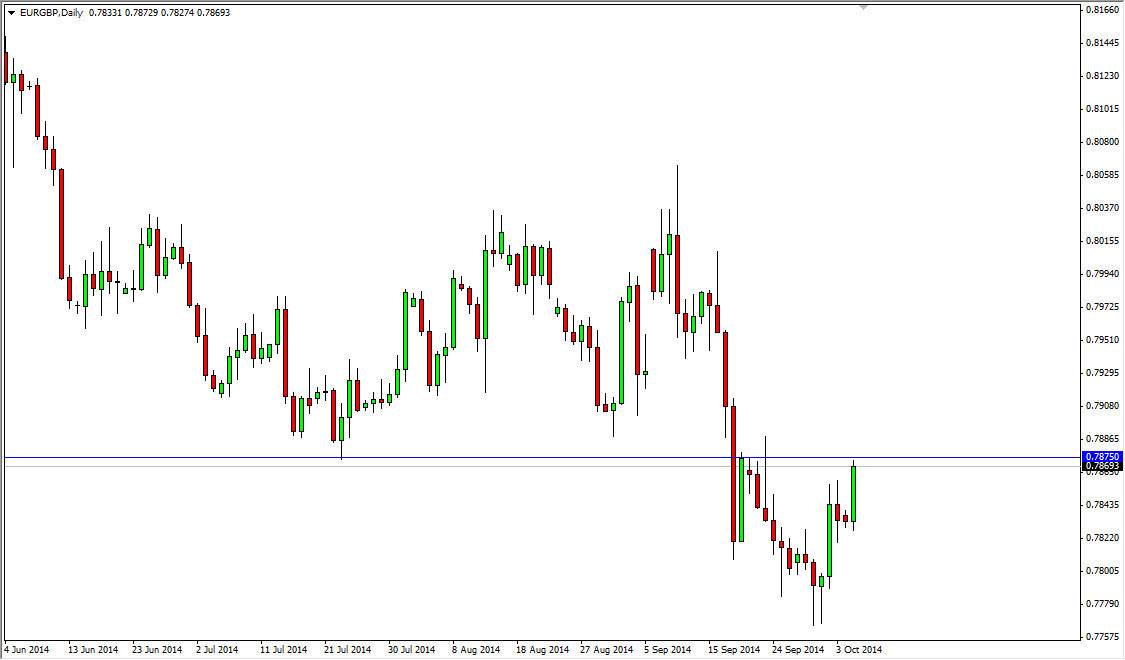

The EUR/GBP pair is one that tends to be very choppy overall, and the recent action of course is in any different. We have rallied during the session on Monday and significantly so, but at the end of the day we are still struggling with the 0.7875 barrier, an area that should be rather resistive based upon recent action. With that, we feel that this market should continue to be one the jobs around but we still recognize that the pair is very bearish.

The candle of course is strong looking, but at the end of the day it is countertrend so I am not overly impressed. That being the case, the market will find plenty of resistance all the way to at least 0.80, and possibly even higher than that. I believe that this is the marketplace that can be sold every time there is a resistant candle, as the trend has been so strong to the downside.

That is unless of course…

Although we are in a significant downtrend, there is the possibility that we change trends. After all, trends do and eventually. We look at this trend as ending if we get above the 0.81 handle. Anything between here and there that looks resistive should be a nice selling opportunity as far as we can tell.

Ultimately, the market should continue to drop and I believe that the 0.77 level should be fairly supportive, so at the end of the day I think that this market is probably going to consolidate with a somewhat negative bias. Don’t look for any big moves, this pair tends to move very slowly, as a move above 50 pips in one day is fairly significant, as opposed to these currencies against the US dollar.

That being said, both of these currencies are currently suffering against the US dollar, and therefore it might be easier to short these currencies against it. In the interim now I believe that there are short-term selling opportunities on resistive candles in this marketplace as we continue to feel the weight of the European issues.