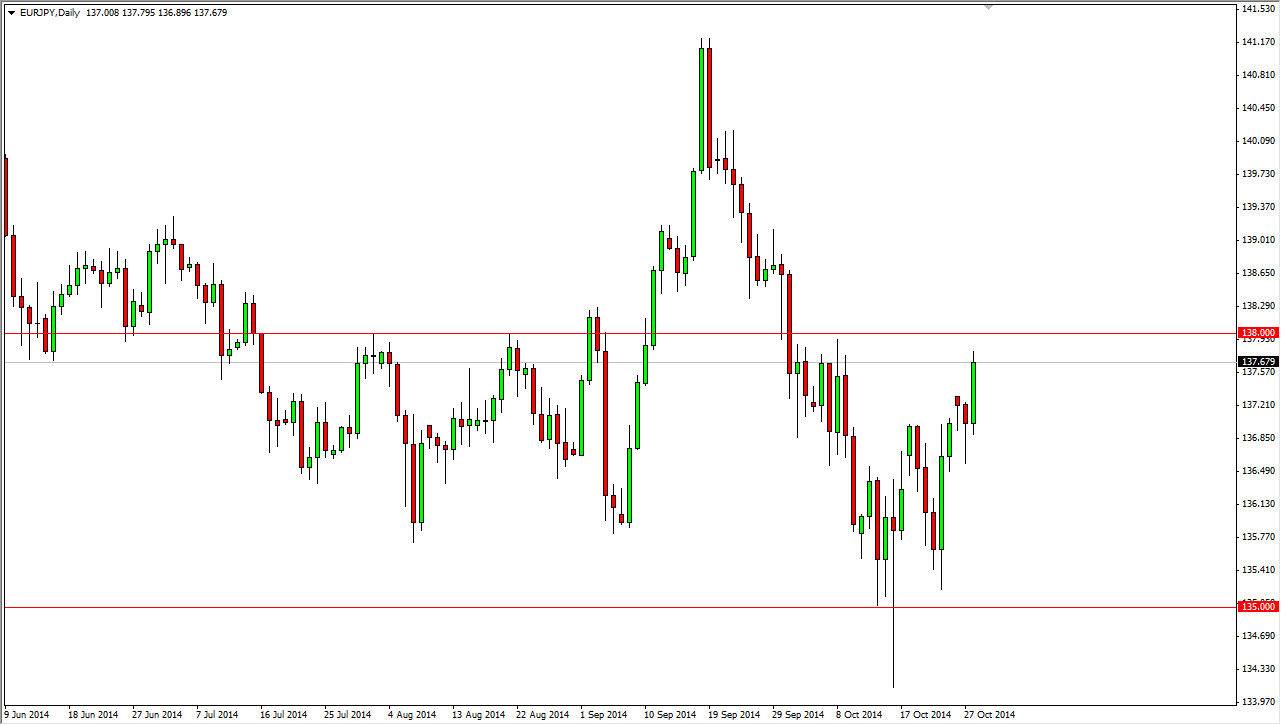

The EUR/JPY pair is a bit of an anomaly when it comes to the Euro. I’m very bearish of the Euro in general, but I also recognize that the Japanese yen is probably one of the few currencies out there that is being sold just as aggressively as the Euro, and perhaps even more so. I recognize that the market breaking above the hammer that had formed on the previous session during the Tuesday trading hours suggests that this market is going to go higher, but I also recognize that the 138 level is resistive.

With that being said, I do expect this market to break above there, and if we can spend four hours above the 138 handle, at that point in time I am more than willing to start buying because I believe that the fact that the Japanese yen continues to get sold off will transfer into this marketplace, even though the Euro is such a miserable currency at the moment.

Interest-rate differentials continue to favor the Euro

The European Central Bank has a long history of disappointing the marketplace when it comes to quantitative easing and loosening monetary policy. On the other hand, the Bank of Japan has pre-much made a career out of doing just that. Ultimately, I believe that longer-term this is a pair that wants to go higher, and that we will eventually break above the 138 level. On that move, I believe that the 140 level should be targeted given enough time, and quite frankly I would not be surprised to see this market go higher. I am paying more attention to the Yen than I am the Euro when it comes to treating the EUR/JPY, as I believe it will simply follow the other yen related pairs. That being said though, I would anticipate that this market may move a bit slower than the GBP/JPY, TRY/JPY, and other such higher-yielding currency pairs. Having said that though, this is a marketplace that should continue to go higher and follow risk appetite. As stocks go higher, typically this pair does as well so keep that in mind.