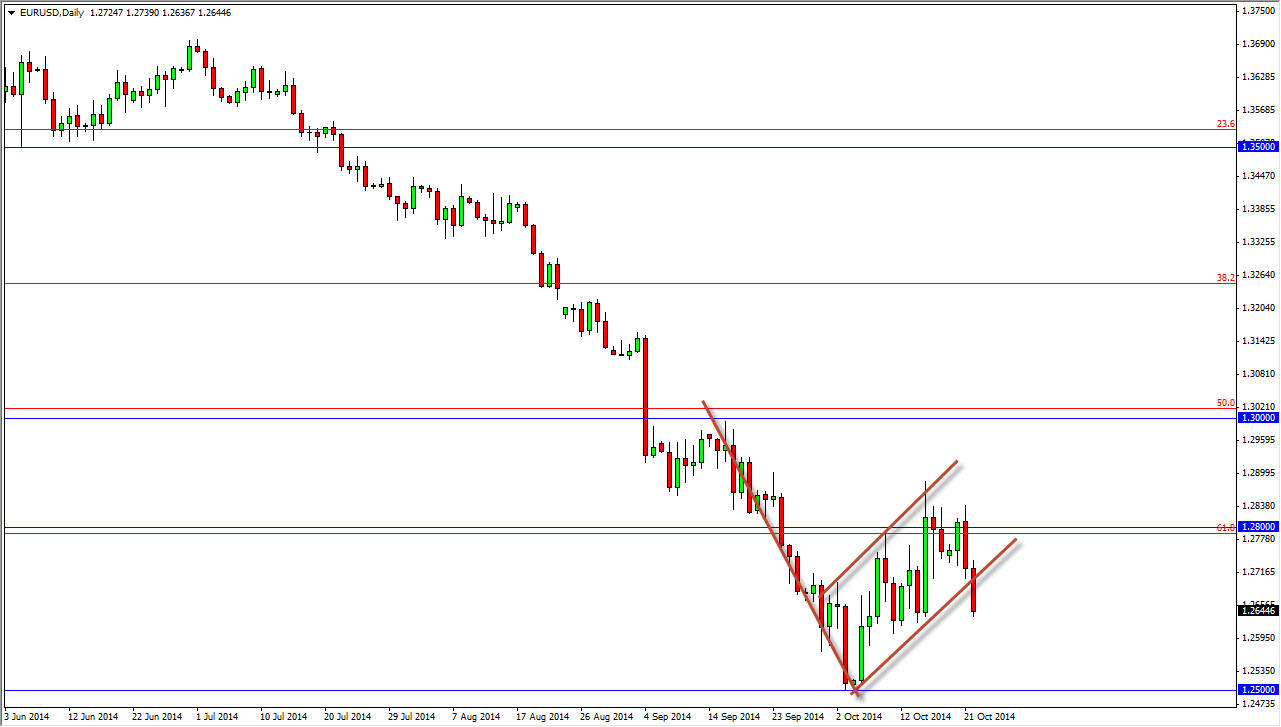

The EUR/USD pair fell during the course of the day on Wednesday, breaking an uptrend line which for me triggers a bearish flag. This bearish flag should be roughly 500 pips worth of selling, and the fact that we broke down somewhere near the 1.27 level tells me that the market should then head to the 1.22 handle. Either way, that is a break of the 1.25 level, an area that I think will be rather supportive. Because of this, I think that it might be a bit of a bumpy ride, but I do not have any interest whatsoever in trying to “pick the bottom” of this pair. I do in fact believe that we go below the 1.25 handle given enough time, and the fact that the European Central Bank has its hands full as the European economy doesn’t exactly look strong at this point in time.

Never fight the trend

Without a doubt, one of the most important pieces of advice I can give newer traders is that you just never fight the trend. It simply is not worth it. Yes, there will come a day when this pair goes higher but I’m not smart enough or lucky enough to know exactly when that is. Once you recognize this, it makes it much easier to trade this marketplace as the back and forth volatility is often very difficult to deal with. I don’t think that the 1.25 level will be broken immediately, it would not surprise me at all to see this market try to break through a couple different times before it actually has success. Nonetheless, I still believe that on the longer-term charts it makes sense that the market goes all the way down to the 1.2050 area, as it would be a “round-trip” of the entire uptrend move that we are recently breaking below.

The only thing that makes me by the Euro at this point in time is if we break above the 1.30 level, something that I do not see happening anytime soon. I suspect that there is a massive amount of resistance between 1.28 and 1.30, so lower prices should be the norm.