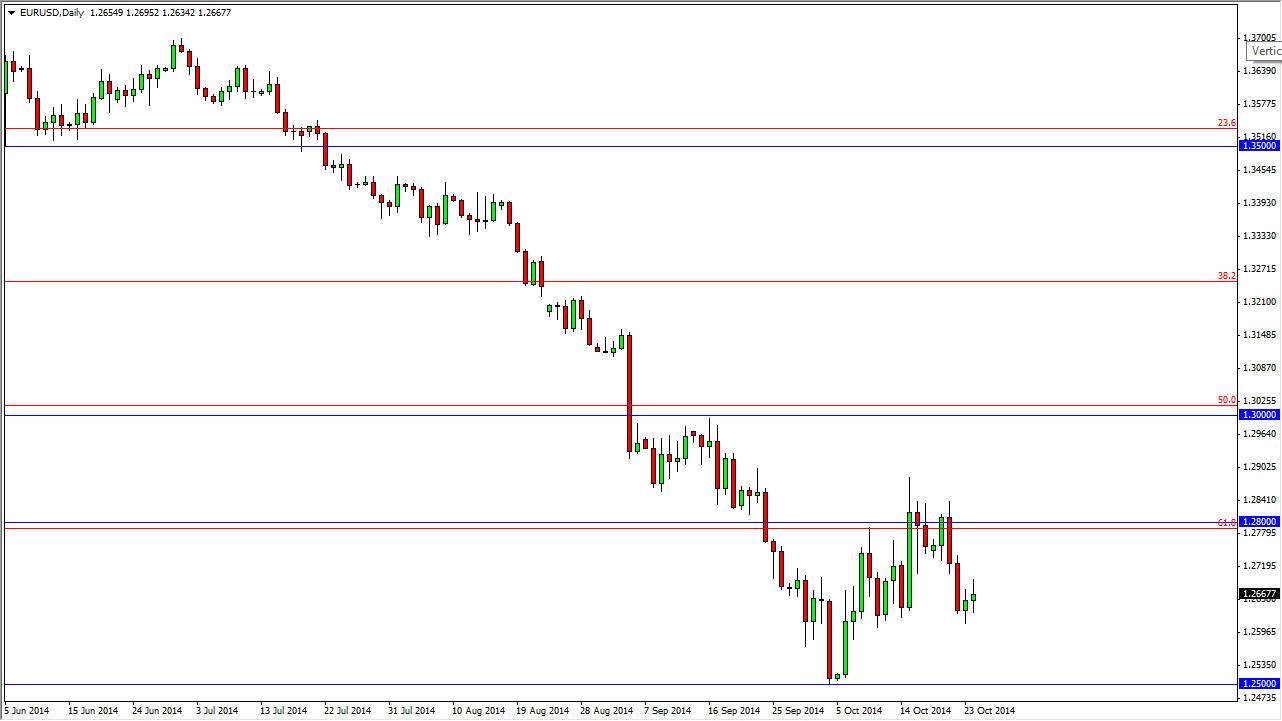

The EUR/USD pair continued to struggle during the session on Friday as the 1.27 level seems to be rather resistive. On top of that, the 1.28 level above is also a resistive area as well, and with that being the case selling this market is essentially the only thing I’m looking to do. That’s not to say that I am always involved, but the truth of the matter is that I don’t see any reason to start buying this market. There are several issues in the European Union at the moment, and I believe that the European Central Bank will have to get involved and probably loosen monetary policy.

With that being the case, the market should continue to favor the US dollar overall, and every time we rally I begin to look for selling opportunities as the market should return to lower levels again and again. It’s hard to imagine a situation where the market feels comfortable going higher for any real length of time, and as a result I’m just not interested at this moment. I also have very specific boundaries that I am paying attention to.

Massive overhead pressure

There is massive overhead pressure as far as I can see, and I believe that the area between the 1.28 and the 1.30 levels should continue to offer significant downward pressure, and it is not until we get above the 1.30 level on a daily close that I would even consider buying the Euro at this point in time. After all, there are far too many reasons the think that this downtrend continues, not the least of which the fact that we broke down below the 1.28 level, which is also the 61.8% Fibonacci retracement level, and that been broken to the downside is a very bearish sign.

On top of that, you could probably make an argument for a bearish flag been formed at the moment, and as a result it does appear that the market is going much lower. Bounces are been sold at this moment, and a break down below the 1.26 level also has me selling. I recognize that the 1.25 level will be massively supportive also, but I do believe that we will eventually break below it.