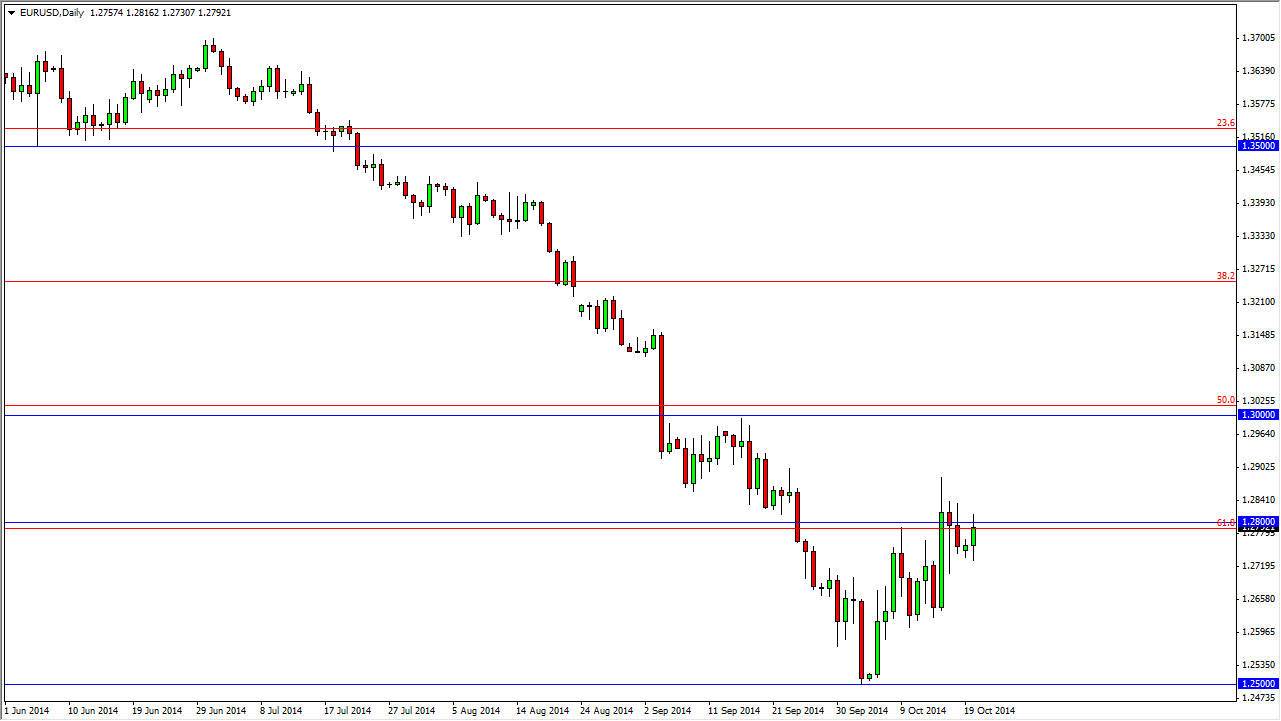

The EUR/USD pair bounced a bit during the session on Monday, testing the 1.28 handle again. However, if you been paying attention to my analysis you know that I believe there is a significant amount of resistance all the way to the 1.30 handle, so that being the case it’s very likely that this market will find plenty of selling pressure sooner or later. Because of this, I am essentially waiting for some type of resistant candle in order to get involved in this market, and am very leery of buying this market as it should continue to see plenty of pressure to the downside. In fact, I do not believe that it’s possible to buy this market with any type of conviction until we get above the 1.30 handle, something that obviously isn’t going to happen today.

Continued bearish pressure for the Euro overall

I believe that there will be continued bearish pressure for the Euro overall, and it certainly won’t be any different against the US dollar. After all, the US dollar continues to be one of the most favored currencies in the world, as the Federal Reserve is stepping out of the quantitative easing game. Yes, we have had a nice little bounce here, but at the end of the day the market was oversold and it needed to have some type of bounce in order to attract new sellers.

If we somehow did get above the 1.30 handle, we could then go to the 1.3250 level, an area that had a gap previously. However, I think that it’s more likely that we head down to the 1.25 handle next, and then make several attempts to break down and get below in order to head to the 1.20 handle given enough time. It doesn’t mean that it will be easy, and it most certainly won’t be right away, but ultimately I do think that this market will try to get down to the 1.20 handle, which would essentially be a round-trip from the original uptrend as we have smashed through the 61.8% Fibonacci retracement level to get here.