EUR/USD Signal Update

Yesterday’s signal expired without being triggered. We did hit 1.2660 but there was no bullish price action there.

Today’s EUR/USD Signals

Risk 0.75%

Entries must be made before 5pm London time.

Short Trade 1

Go short following bearish price action on the H1 time frame following a first touch of 1.2662.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

Short Trade 2

Go short following bearish price action on the H1 time frame following a first touch of 1.2713.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

EUR/USD Analysis

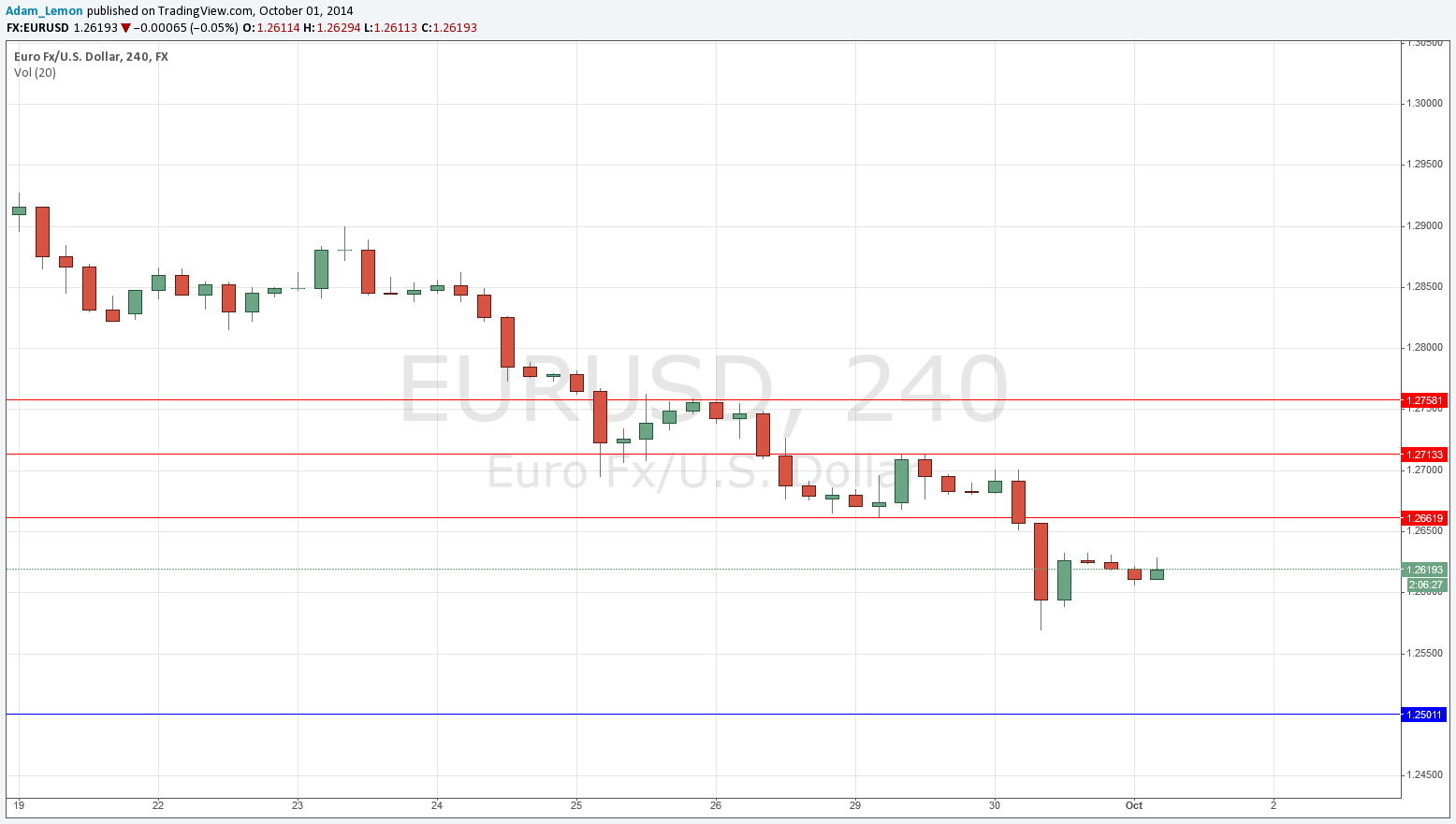

Yesterday produced a surprising and sudden move down all the way to 1.2570, from where the price initially rose with some momentum before settling down overnight.

We have made a new low and the strongly bearish trend continues.

We have produced more inflection levels that could be useful for shorts on pullbacks, at 1.2662 and 1.2713.

Below us the key psychological level of 1.2500 is likely to be supportive and even before that there is likely to be some buying, so the area between 1.2570 and 1.2500 is a zone it which it should pay to be careful.

There are no high-impact data releases scheduled for today which are likely to affect the EUR. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm London time. Later at 3pm, there will be a release of ISM Manufacturing PMI data. Therefore this pair is likely to be relatively quiet until the New York session begins. The few days before the NFP Friday which is coming up at the end of this week are traditionally quiet for USD pairs before the final data release on the Friday.