EUR/USD Signal Update

Yesterday’s signal was not triggered and expired. We did hit 1.2662 but that happened during the Tokyo session.

Today’s EUR/USD Signals

Risk 0.75%

Entries may only be made between 8am and 5pm London time.

Short Trade 1

Short entry following bearish price action on the H1 time frame after a first touch of 1.2712.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride ensuring there is no risk left in the trade.

Short Trade 2

Short entry following bearish price action on the H1 time frame after a first touch of 1.2755.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride ensuring there is no risk left in the trade.

EUR/USD Analysis

Yesterday was a significant day, as after a news release of quite usual U.S. economic numbers, the USD sold off quite heavily, and the JPY strengthened. This trend continued overnight although it has been reversing a little in early trading this morning.

However the EUR/USD pair has had the smallest USD reversal. Of all the major currencies, the EUR is behaving the most weakly.

The USD sell-off may be a blip or pull-back within the trend or the first sign of the end of the bullish USD trend. It seems logical that the USDJPY hitting 110.00 would have triggered some profit taking.

This means that we can still have a bearish bias on this pair, but we need to be more careful. The good news is that this will bring levels more into play.

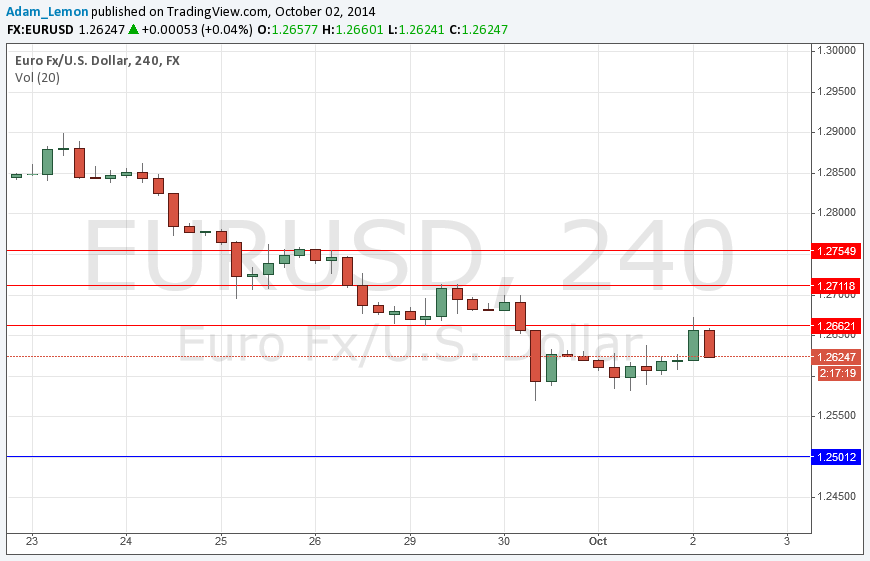

The chart below shows that early today we hit flipped support to resistance at 1.2662 and we have been falling since there. This fall might be the direction for the day. However we have key EUR and USD news during the New York session so it would be logical to not expect much movement in the price before then.

There are further likely resistant levels above at 1.2712 and 1.2755.

Below, the key psychological level of 1.2500 is likely to be supportive.

There are high-impact data releases scheduled for today which are likely to affect both the EUR and the USD. At 12:45 London time there will be a release of the EUR Minimum Bid Rate, followed 15 minutes later by an ECB Press Conference and US Unemployment Claims data. This pair is likely to be relatively quiet until the New York session begins, when there might be volatility triggered by these events.