EUR/USD Signal Update

Last Wednesday’s signal was not triggered as although 1.2759 was hit during that day’s London session, there was no following bearish price action at the level.

Today’s EUR/USD Signals

Risk 0.75%

Entries may only be made before 5pm London time.

Short Trade

Go short at the first touch of 1.2900.

Place the stop loss at 1.2931.

Adjust the stop loss to break even when the trade is 31 pips in profit.

Take off 50% of the position as profit when the trade is 31 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

Long Trade

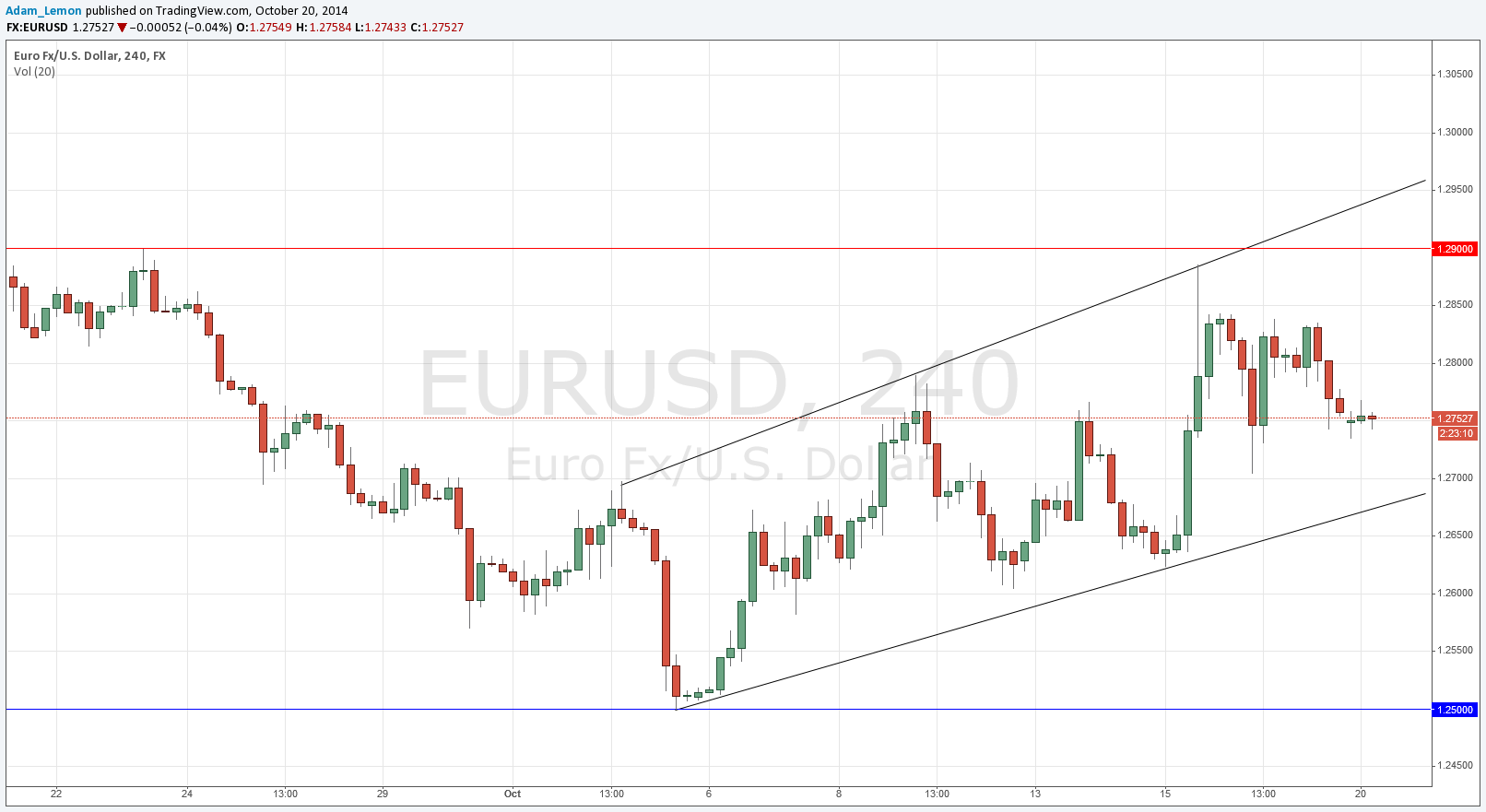

Go long following bullish price action on the 1H1 time frame H1H1H1 time frame following the first touch of the lower bullish trend line shown in the chart below, which currently sits at around 1.2677.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

EUR/USD Analysis

Since my last forecast some days ago, the EUR has been showing some unexpected bullishness across the board, as can be seen from a quick look at a chart of EUR/JPY for example. The H4 chart shown below shows not only a succession of higher lows following the strong move up from 1.2500, but also shows that we seem to be establishing a bullish channel. We have also recently broken or at least muddied the resistance zone that was previously established around the key psychological level of 1.2750. Therefore I am prepared to look for a long trade off the lower channel trend line if the price should fall there.

Above us the next key flipped level is confluent with the round number at 1.2900. A short touch trade could be taken there in the very unlikely even we should reach that price today.

There are no high-impact data releases concerning either the EUR or the USD today. Therefore it is likely to be a quiet day for this pair.