EUR/USD Signal Update

Neither of last Thursday’s signals was triggered.

Today’s EUR/USD Signal

Risk 0.75%

Trade between 8am and 5pm London time only.

Short Trade 1

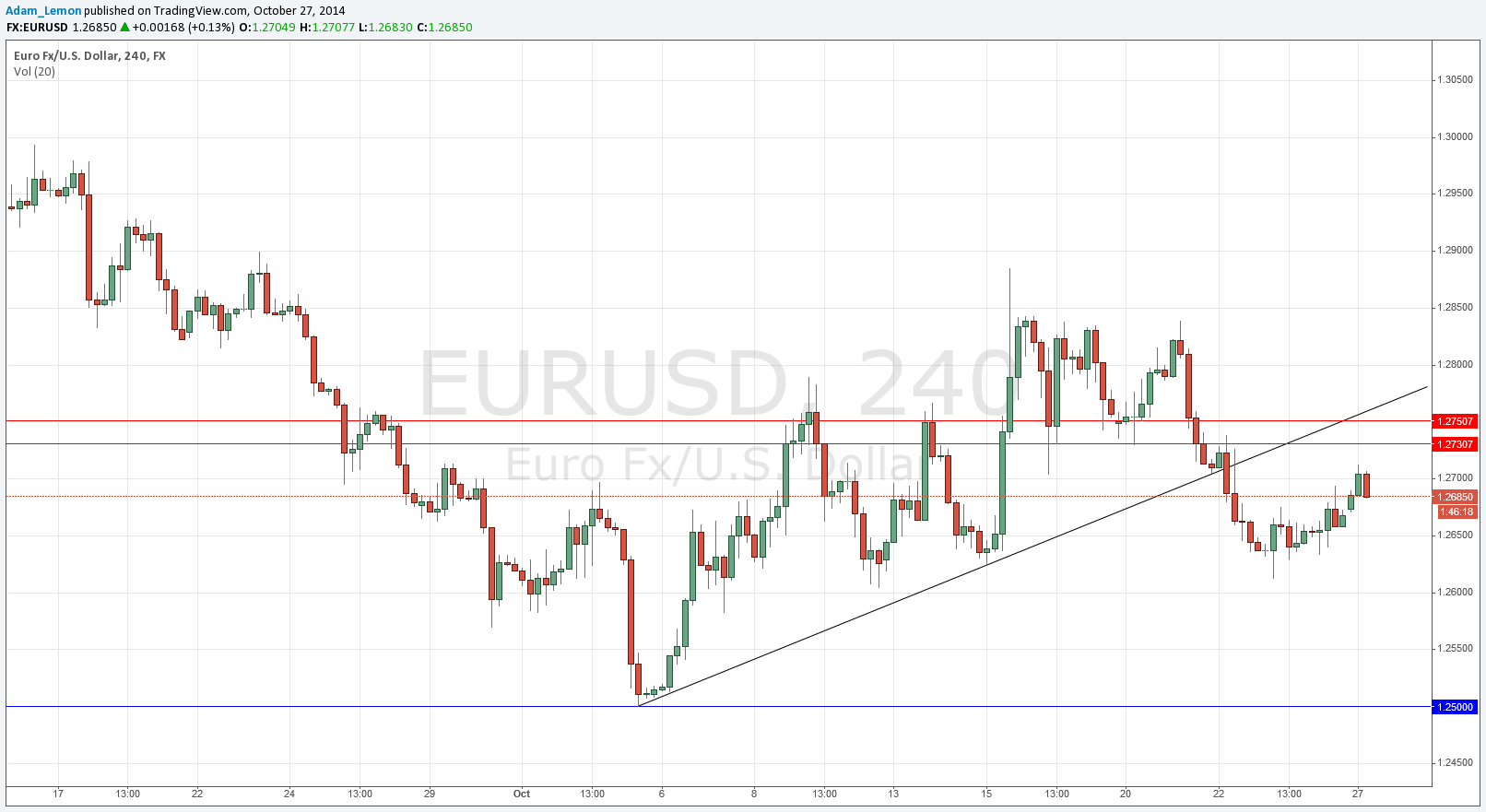

Go short following strongly bearish price action on the H1 time frame from the anticipated resistance zone between 1.2730 and 1.2750 shown in the chart below.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short following bearish price action on the H1 time frame following a retest of the broken trend line shown in the chart below.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

I wrote last Thursday that some positive EUR news was likely to pop the price up and that is exactly what happened a little later that day. The gentle upwards pull back has been continuing since then. The price has begun to fall during today’s pre-London session.

I am bearish on this pair due to the long-term fall in the EUR and rise in the USD, so it would not be that surprising if we already made the high of this week. However if you want to look for logical areas to enter short trades, the zone from 1.2730 to 1.2750 is certainly a logical area to expect resistance. Beyond that there is the broken trend line that could provide a launch pad for a renewed push downwards.

My colleague Christopher Lewis expects the 1.2800 level beyond that to be very resistant.

There is a high-impact data release scheduled today concerning the EUR, but there is nothing regarding the USD. At 10am London time German IFO Business Climate data will be released.