EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken before 5pm London time.

Short Trade 1

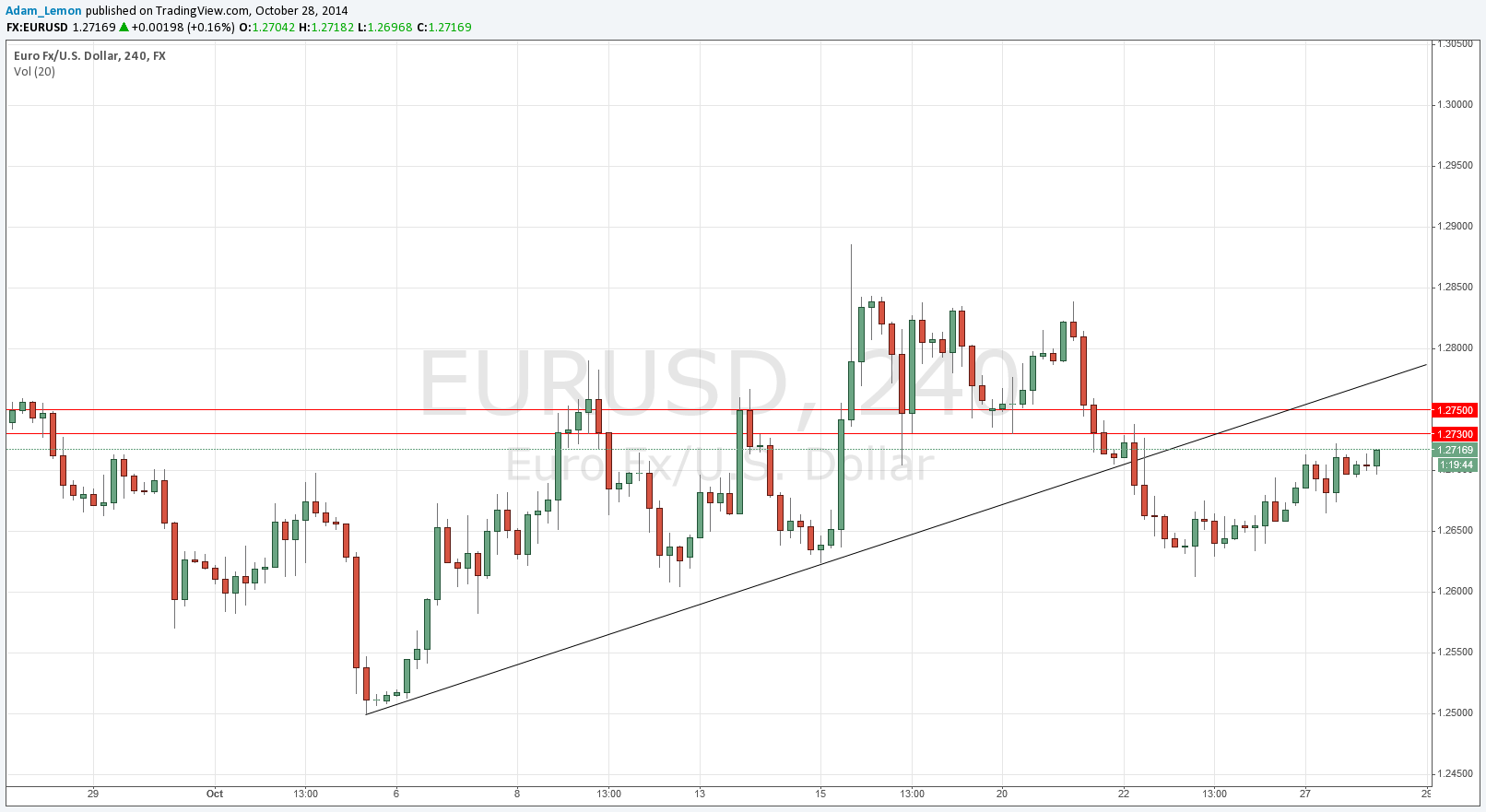

Short entry following strongly bearish price action on the H1 time frame at the anticipated resistance zone between 1.2730 and 1.2750 shown in the chart below.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry following bearish price action on the H1 time frame following a retest of the broken trend line shown in the chart below.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

There is very little left to say that I didn’t already say in my forecast yesterday morning, as it was a very quiet day, ending with a slight rise.

At the time of writing we have still not touched the probable resistant area between 1.2730 and 1.2750, which would be a logical place for a reversal back into the longer-term bearish trend to occur. A look at the daily chart will show that the stronger recent candles are generally the bearish ones.

If the pair does manage to break past 1.2750, it could reverse at the broken trend line which currently sits at around 1.2770.

My colleague Christopher Lewis is also looking at going short below 1.2800.

There are high-impact data releases scheduled today concerning the USD, but there is nothing regarding the EUR. At 1:30pm London time there will be a release of U.S. Core Durable Goods Orders data, followed later at 3pm by CB Consumer Confidence. Therefore this pair is likely to be most active during the first half of the New York session.