EUR/USD Signal Update

Yesterday’s signal for the short off bearish price action at 1.2730 – 50 was triggered when a bearish H1 pin bar was printed and broke down. Unfortunately this move has not followed through and did not break even, so it should be prudent to cut the loss here and exit the trade immediately.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm London time only.

Take the risk off the trade before the Federal Reserve Announcements at 6pm London time.

Short Trade

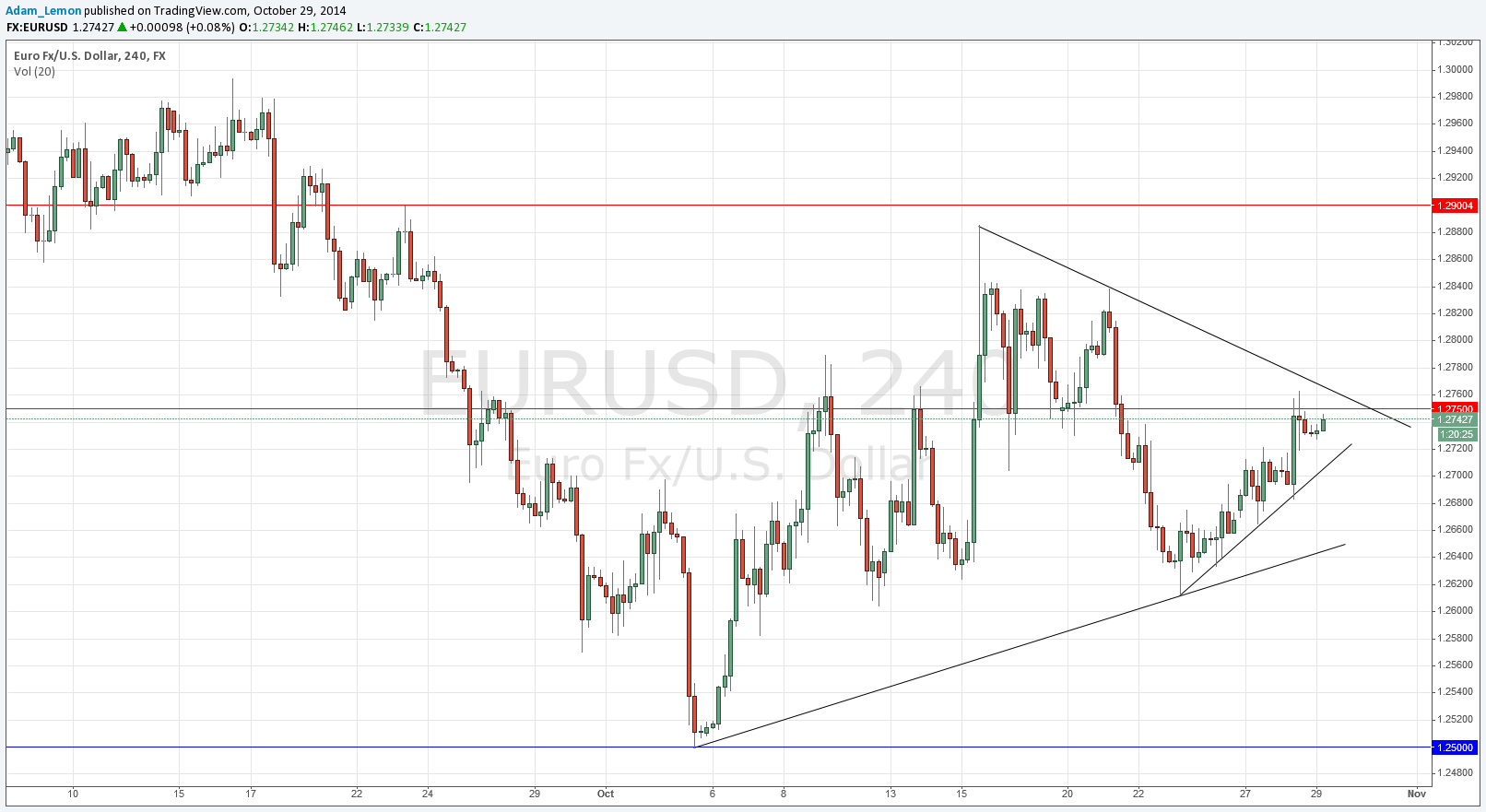

Go short following strongly bearish price action on the H1 time frame at the upper triangle trend line shown in the chart below.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 20 pips in profit.

Take off 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade

Go long following bullish price action on the H1 time frame at the lower triangle trend line shown in the chart below.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 20 pips in profit.

Take off 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

Yesterday I forecast that the best bet would be a short off the resistance zone from 1.2730 to 1.2750, which was seen as likely to hold. This is in fact what happened, but there has not been a bearish follow-through, and although 1.2750 may yet still hold the pair is feeling dangerously bullish.

There is big USD news due this evening after London closes, and for that reason it is likely that there will be no major breakouts before then.

The chart is beginning to get interesting as we are forming a consolidating triangle and approaching its narrow tip. There might be bearish action later confluent with the resistant level at 1.2750. Alternatively, a fall to the lower trend line followed by a bounce could be a good launch for a long. These might give opportunities to be positioned for a larger move later if there are no big whipsaws. However it will be important to take the risk off the trade before the announcements are made.

There are high-impact data releases scheduled today after London closes concerning the USD, but there is nothing regarding the EUR. At 6pm London time there will be a release of the U.S. FOMC Statement and Federal Funds Rate. These are likely to have a significant impact upon the USD and so the pair may be relatively quiet during today’s London session.