EUR/USD Signal Update

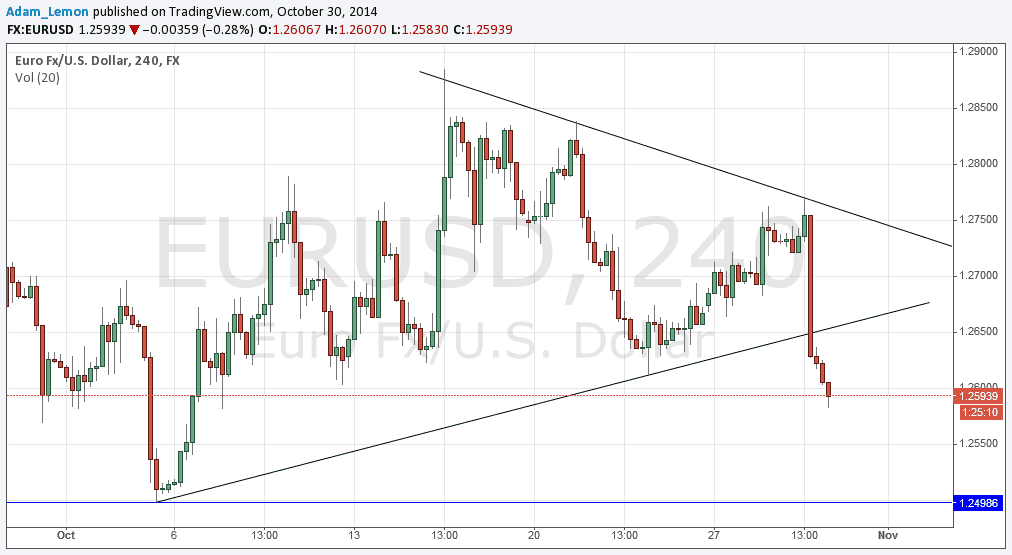

Yesterday’s short signal was triggered by the bearish pin bar off the upper triangle trend line identified in yesterday's chart.

This trade is currently heavily in profit and some partial further profit should be taken immediately.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken before 5pm London time.

Long Trade

Long entry following bullish price action on the H1 time frame at the first touch of 1.2500

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Yesterday I forecast that the resistance at 1.2750 would hold until the high-impact USD news was released last night, and although we did pop above that level to some extent, the upper trend line did in fact hold and was an excellent location at which to be positioned short just before the news release. This was supported by the price action. I saw this looked to be a good bet as long USD and short EUR is a positioning in line with two of the major longer-term trends in the Forex market, and when you have technical analysis and a possible push from major news to begin a reignition of such a trend after a prolonged pullback, it can be a devastatingly effective combination.

The price has fallen hard on the news, by almost 200 pips, and at the time of writing we are below 1.26 and about 90 pips from the year's low of 1.2500. It seems we have fallen too far for any new shorts, but in the very unlikely event we fall today to 1.2500, a double bottom at that key level could be a good place to be positioned long for a natural bullish reaction.

At some unknown hour there will be a release of German Preliminary CPI data which is likely to affect the EUR. Regarding the USD, there will be key releases of Advance GDP and Unemployment Claims data at 12:30pm London time, followed by a speech by the Chair of the Federal Reserve half an hour later: these events are likely to affect the USD. It is likely to be an active day for this pair.