EUR/USD Signal Update

Last Thursday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Entries must be taken before 5pm London time only.

Short Trade 1

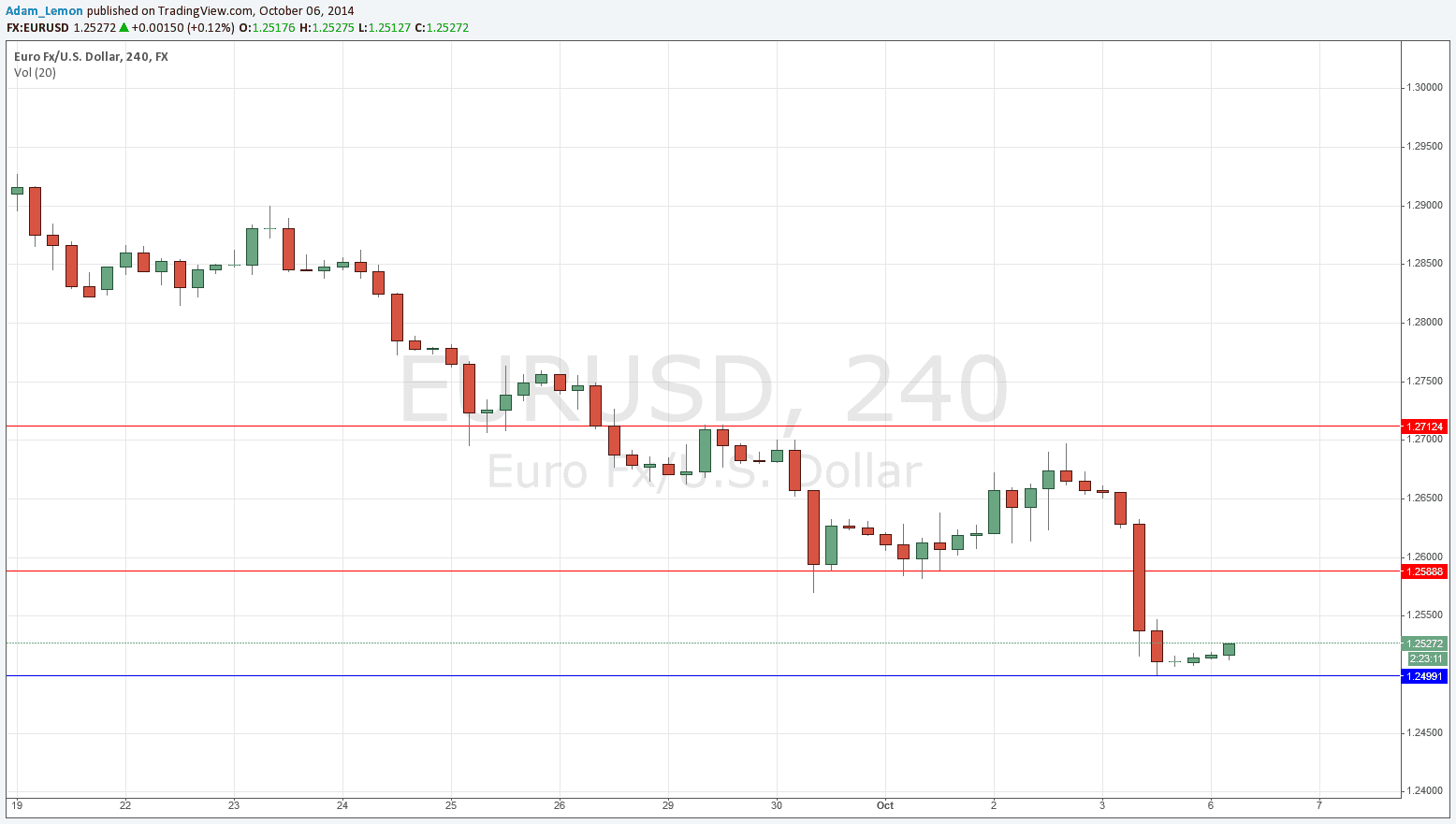

Go short following bearish price action on the H1 time frame after a first touch of 1.2712.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

Short Trade 2

Go short following bearish price action on the H1 time frame after a first touch of 1.2588.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

EUR/USD Analysis

I wrote last Thursday that I maintained a bearish bias but expected the level at 1.2500 to be supportive. So far both have been proven to be correct, as the sharp fall that began on Thursday with the reversal of the ascending channel was fuelled dramatically by the NFP data that was released on Friday, boosting the USD greatly. This pushed the price down to the 1.2500 pretty much exactly, and we have been gently rising off that since the market opened last night.

It is quite probably that nothing much will happen today, but in the case that this pair does rise, there might be short opportunities, especially at 1.2588. This is not a flipped support to resistance level but it is quite likely to provide a turning point in this market environment.

There are no high-impact data releases scheduled for today which are likely to directly affect either the EUR or the USD. Therefore it is likely to be a quiet day for this pair.