EUR/USD Signal Update

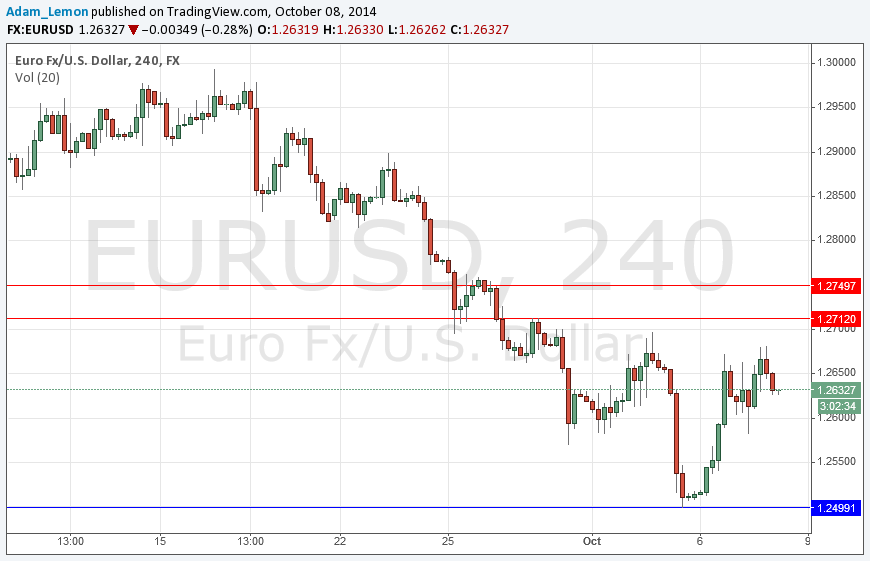

Yesterday’s signals were not triggered and expired as the price never reached 1.2712.

Today’s EUR/USD Signals

Risk 0.75%

Entries should only be made between 8pm London time and 5pm New York time.

Short Trade 1

Go short following bearish price action on the H1 time frame after a first touch of 1.2712.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

Short Trade 2

Go short following bearish price action on the H1 time frame after a first touch of 1.2750.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

EUR/USD Analysis

I had forecast that yesterday would be quiet and choppy. It wasn’t that quiet, but it certainly was choppy, as the pair initially fell, then rose with some energy, before falling about 50 pips after the New York close last night. This choppiness is expressed on the daily chart by double inside candles by the beginnings of a “barbed wire” formation, and the result is that price movements are currently quite unpredictable between 1.2500 and 1.2712. Overall this is really not surprising, as the market is awaiting the FOMC statement after London closes this evening, which might well give some more direction to the USD. For that reason, I give signals that are only applicable today to that period after the statement up to New York’s close.

There are no high-impact data releases concerning either the EUR or the USD scheduled for today’s London session. Later, at 7pm London time, there will be a release of the U.S. FOMC Meeting Minutes which is likely to affect the USD. It might be a quiet day until then.