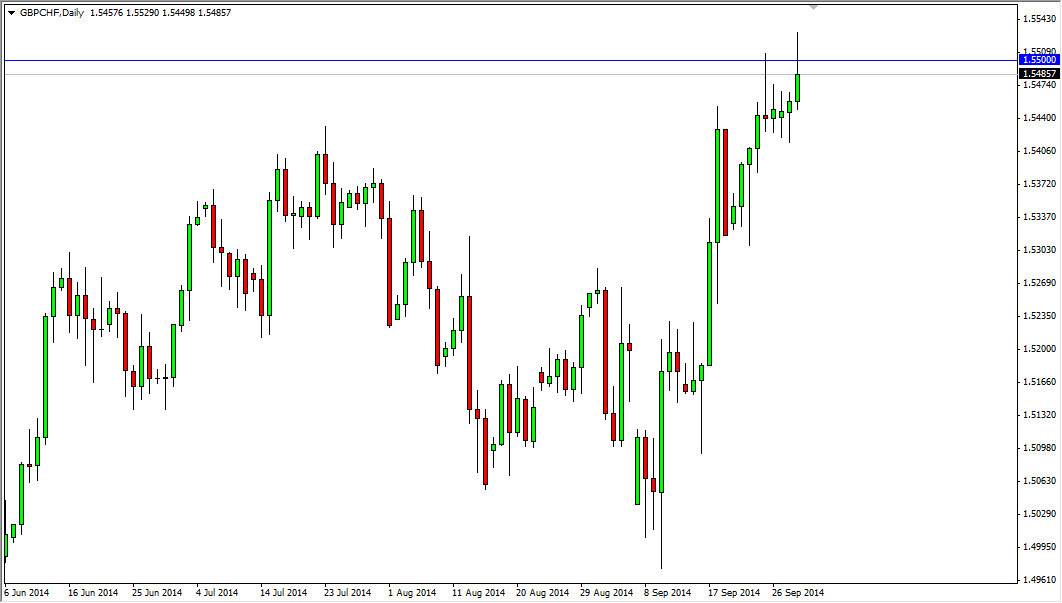

The GBP/CHF pair broke higher during the course of the day on Tuesday, slicing through the 1.55 level at one point during the trading session. The market fell back below that area though, and ended up forming a bit of a shooting star. Recently, we have seen it to shooting stars and several neutral looking candles. I believe that shows of the 1.55 level is in fact going to be massively resistive, but it appears that that the resistance is in fact starting to break down a little bit. If we break above the top of the range for the session on Tuesday, I feel that the market could break out and head towards the 1.60 handle.

Remember, the market tends to reflect the risk appetite around the world, as the pair goes higher with more risk appetite, and lower when people are more concerned. After all, the Swiss franc is without a doubt one of the more safe currencies out there, and the British pound tends to be a funding currency for exotic trades.

Wild ride, but a fun trade nonetheless.

This pair tends to be wild ride, but it is a fun trade nonetheless. After all, you can enjoy a large gains suddenly, but needless to say you can enjoy a large losses. It is very volatile, but it does tend to move quite nicely in one direction or the other as soon as it makes up its mind. Recently, we have seen quite a bit of bullish pressure, but it has been a bit parabolic. Because of this, we could go sideways in general, but I do think ultimately it’s only a matter time before the buyers come in.

I see risk appetite possibly going higher anyways, and several different markets, not just this one. This is one of my favorite ways to play the “risk on” or “risk off” attitude of the marketplace overall, and as a result I am most certainly paying close attention to this chart.