GBP/USD Signals Update

Yesterday’s signal expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Entries must be made before 5pm London time.

Long Trade

Long entry following bullish price action on the H1 time frame following a first touch of 1.6154 – 1.6165.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride. Ensure the risk is taken off the trade.

Short Trade

Short entry following bearish price action on the H1 time frame following a first touch of 1.6282.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride. Ensure the risk is taken off the trade.

GBP/USD Analysis

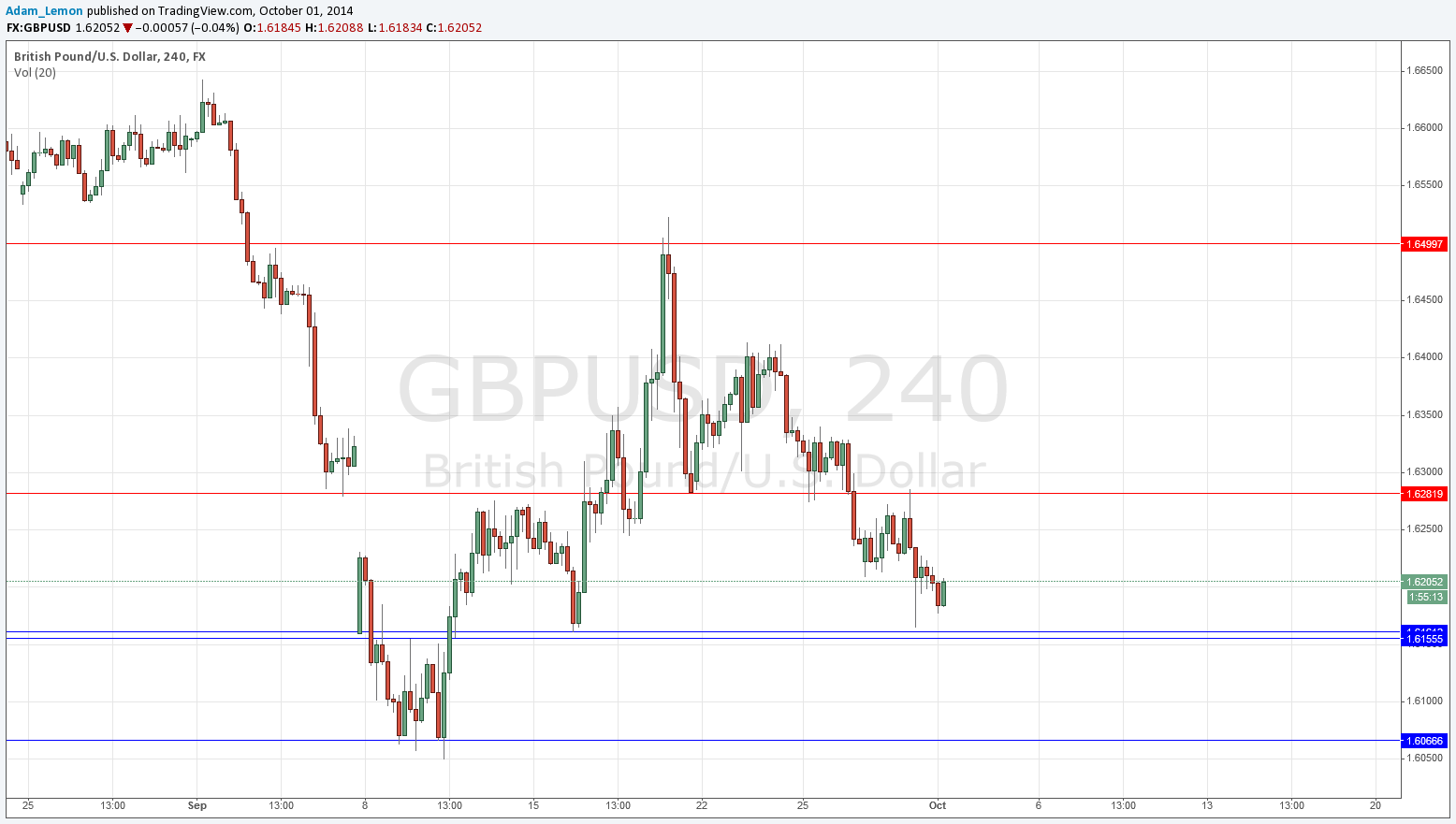

Yesterday we just kissed the support zone I had identified with an upper limit at 1.6166, and we have moved up from there so it did in fact prove to be supportive. As you can see from the chart below this has been a crucial pivotal zone so even though it is a little soon, I would look for longs there again today.

Above us there is flipped support to resistance at 1.6282, which should be a good level at which to look for shorts.

There is nothing beyond either side from 1.6500 to 1.6067.

There are high-impact data releases scheduled for today which are likely to affect both the GBP and the USD. At 9:30am London time there will be a release of GBP Manufacturing PMI data for the U.K. Later at 3pm, there will be a release of ISM Manufacturing PMI data. The few days before the NFP Friday which is coming up at the end of this week are traditionally quiet for USD pairs before the final data release on the Friday.