GBP/USD Signals Update

Yesterday’s signal to go long following bullish action on the H1 time frame after a first touch of 1.6154 – 1.6165 was triggered by a bullish engulfing bar after a sharp rejection of that zone. The signal was to take 50% as profit after 30 pips and move the stop to break even, so the trade would have been a winner after closing with some booked profit.

Today’s GBP/USD Signals

Risk 0.75%

Entries may only be made between 8am and 5pm London time.

Short Trade

Go short following bearish price action on the H1 time frame following a first touch of 1.6282.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride. Ensure the risk is taken off the trade.

GBP/USD Analysis

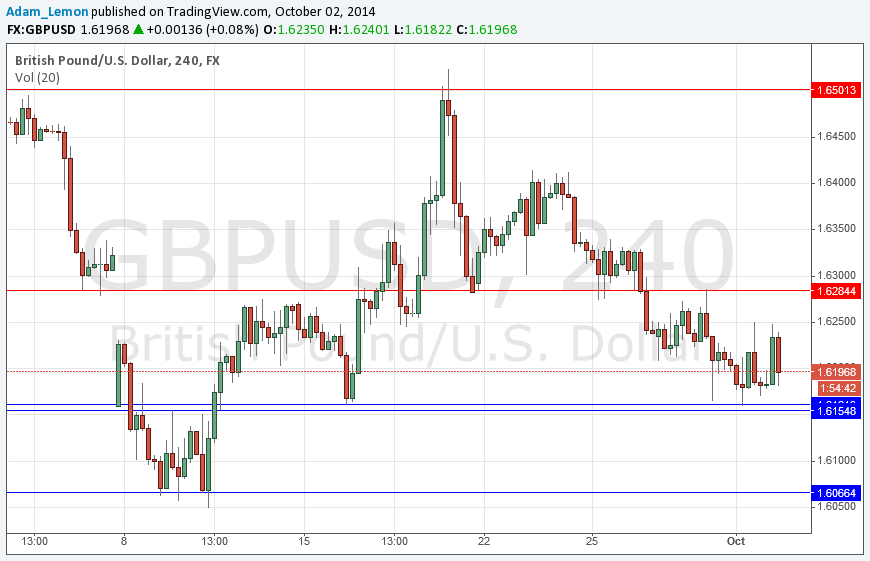

Yesterday we bounced up off the support zone I had identified at 1.6166, but despite the USD selloff that happened yesterday, which was significant, we failed to break above 1.6250 and there is a local double top at that level now.

We are now heading down towards that supportive zone again, and it is too soon to look for another long trade there with comfort, although it may well prove to be supportive again in this choppy environment.

A short off likely resistance at 1.6282 looks more attractive and likely.

There is nothing beyond either side from 1.6500 to 1.6067.

There are high-impact data releases scheduled for today which are likely to affect both the GBP and the USD. At 9:30am London time there will be a release of GBP Construction PMI data for the U.K. Later at 3pm, there will be a release of ISM Manufacturing PMI data. Later at 1:30pm there will be the release of US Unemployment Claims data.