The GBP/USD pair went back and forth during the session on Tuesday, essentially settling nothing. That being said though, we do have a Federal Reserve interest rate decision coming out today, as well as a statement. This will give us an idea as to what the Federal Reserve is willing to do and what it’s thinking about as far as monetary policy is concerned going forward. Obviously, you have the US dollar being greatly influenced by what’s about to happen, and that being the case we feel that this market will more than likely moving during the session, based mainly upon the US dollar and not necessarily the British pound.

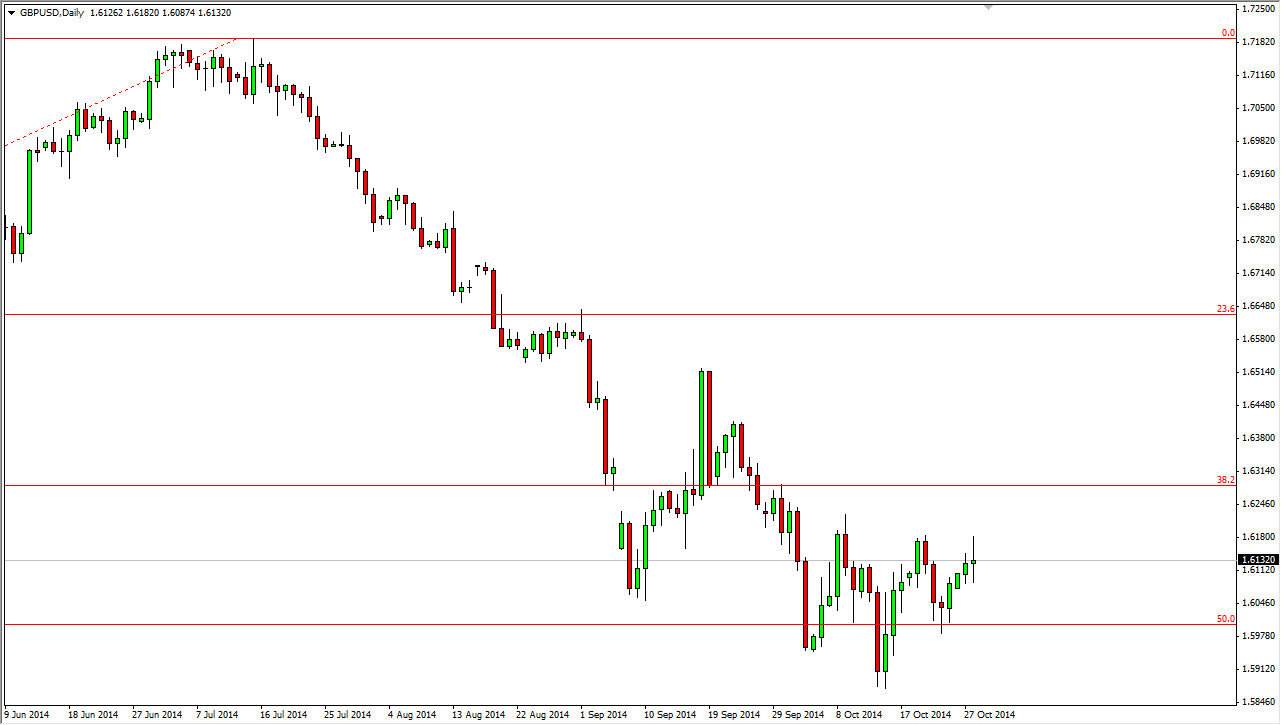

I believe that the 1.62 level is resistance, but if we can get above there on a daily close I think that’s also a nice buying opportunity as the longer-term charts certainly look bullish. After all, we ended up having a nice hammer for the previous week, which of course is a nice buying opportunity under most conditions. That hammer of course is found that the 50% Fibonacci retracement level from the longer-term move, and that of course is going to catch a lot of attention. However, you have to keep in mind that this is an attempt to turn the trend back around, and that always takes a bit of effort.

A dovish statement out of the Federal Reserve would send this market racing

If for some reason the statement out of the Federal Reserve is very dovish, this pair will probably skyrocket at that point in time. I would anticipate a move above the 1.62 level, and then eventually to the 1.65 handle which of course would have a little bit of a psychological impact on traders. Based upon the longer-term charts though, I feel that the market will more than likely eventually head back to the 1.72 level, as it would be a return to the highs after a 50% Fibonacci retracement pullback.

Nonetheless, a lot of answers will be answered during the session today, and as a result I’m probably going to let the daily candle form before I actually risk any money in this market. Nonetheless though, I do think that the buyers will probably come out on top given enough time.