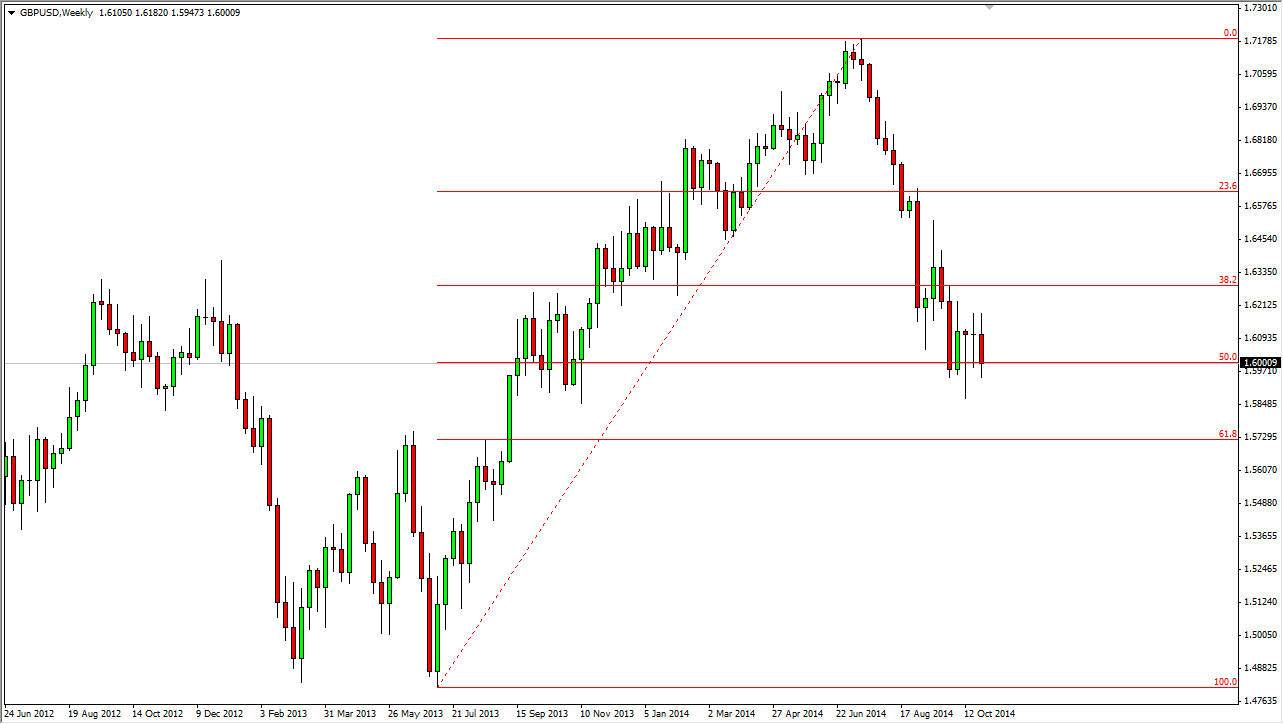

The GBP/USD pair has been bouncing around the 1.16 level for most of the month of October. What I find significant is the fact that it is the 50% Fibonacci retracement from the entirety of the uptrend, and that the support has shown itself time and time again. With that being the case, it would not surprise me at all to see this market bounce from here and go much higher. Believe Iran, I’m not necessarily looking to sell the US dollar in general, but the British pound might be a bit of an anomaly.

The hammer that form during the month was very telling, and it essentially stopped the downtrend in its tracks. I believe that if this 1.60 region holds, we could make a return to the highs which was at roughly 1.72, giving us a nice move higher. With that being the case, I am not looking at selling this market right now. In fact, I believe the pullbacks will continue to be buying opportunities going forward, as we should eventually break out to the upside.

The other side of the coin…

The other side of the coin of course is that if we break down below the hammer that had formed during the month of October, we could very easily see the market break down to the 61.8% Fibonacci retracement level, which is at roughly 1.57 or so.

Ultimately, I don’t think that’s going to happen but even if it did, I think that we find even more support in that general vicinity, and with that could probably be even more aggressively bullish of the market on supportive candles. I don’t think that’s going to happen during the month of November at least, and I fully anticipate writing analysis towards the end of the month that has this pair closer to the 1.6350 region. After that, we will probably slow down during the holiday season, but ultimately we should go much higher, once the traders come back from holiday us are pushing the markets next year.