The XAU/USD pair extended its gains yesterday and scored its highest settlement in four weeks as weakness in the American dollar and pullbacks in major stock markets spurred investors’ appetite for the relative safety of the precious metal. Recent losses in U.S. stocks raised fears about a stronger correction. It appears that some investors are taking money off the table in equities and using it to increase their gold holdings as a result of a heightened need for disaster insurance. I think the primary driver of gold prices in coming weeks will be investors' concerns about equities markets.

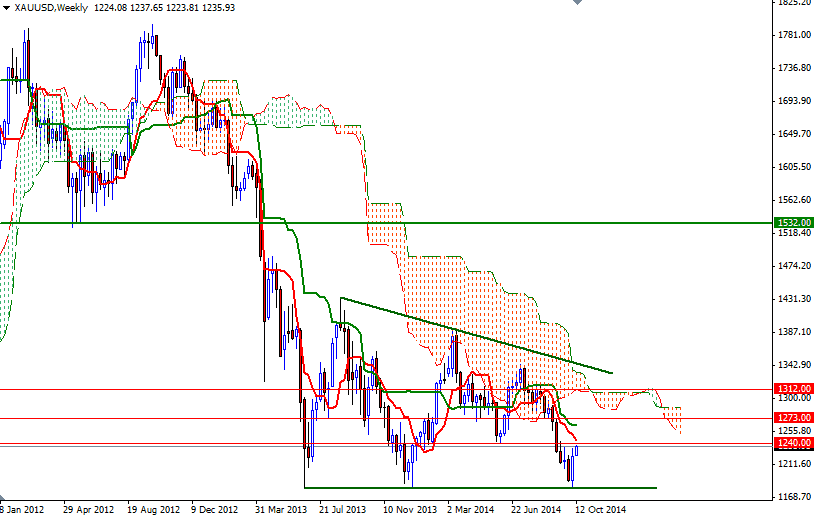

However, as I told in my monthly analysis, the Federal Reserve’s decision on interest rates and economic growth in the world's biggest economy will be the long-term drivers of gold. The XAU/USD pair has been picking up momentum since the prices bounced off of the 1180/3 support level but there are tough barriers ahead. The Ichimoku cloud on the daily chart indicates an area of resistance and when the cloud coincides with another form of resistance, they can be quite powerful.

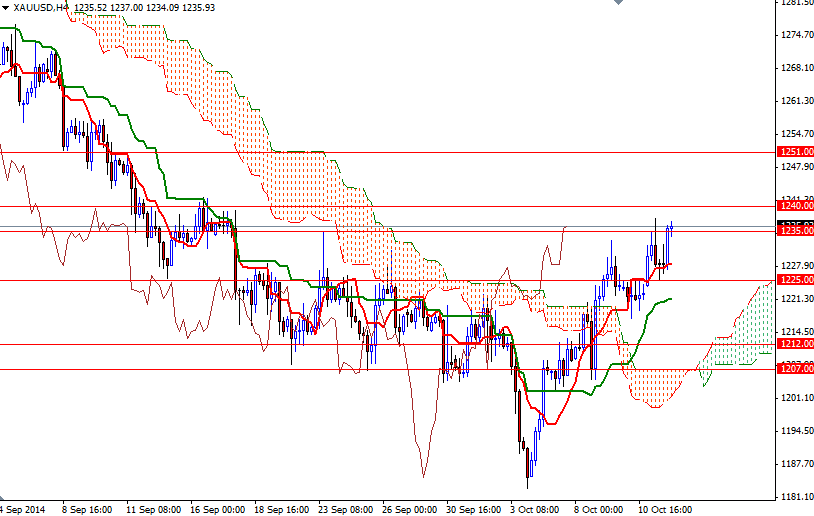

I think the area between the 1235 and 1240 levels will be the key for a bullish continuation. If prices climb and hold above the 1240 resistance level, the bulls might gather enough strength to challenge the bears at 1251. To the downside, the first support to pay attention is located at 1225. The bears will have to pull the market below the Kijun-sen line (twenty six-day moving average, green line) which currently sits at 1220 on the daily chart in order to revisit the 1212 level.