The XAU/USD pair closed lower than opening as the American dollar gained significant strength across the board following the Federal Reserve's statement. The Federal Reserve ended its third round of asset purchases and focused on bright U.S. economic outlook rather than slowdowns in Europe and Asia. The Federal Open Market Committee said that "Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources is gradually diminishing" at the conclusion of a two-day meeting yesterday.

Although the Fed maintained its commitment to keep interest rates low for a "considerable time", general tone was more hawkish than investors expected and that dragged the XAU/USD pair below the $1220 support level. As a result, speculative selling pressure intensified and the pair traded as low as $1208.30, the lowest price since October 8.

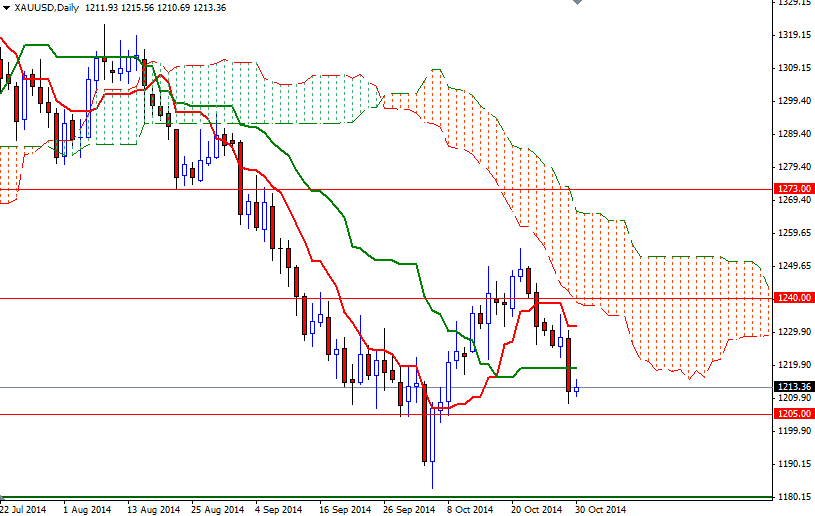

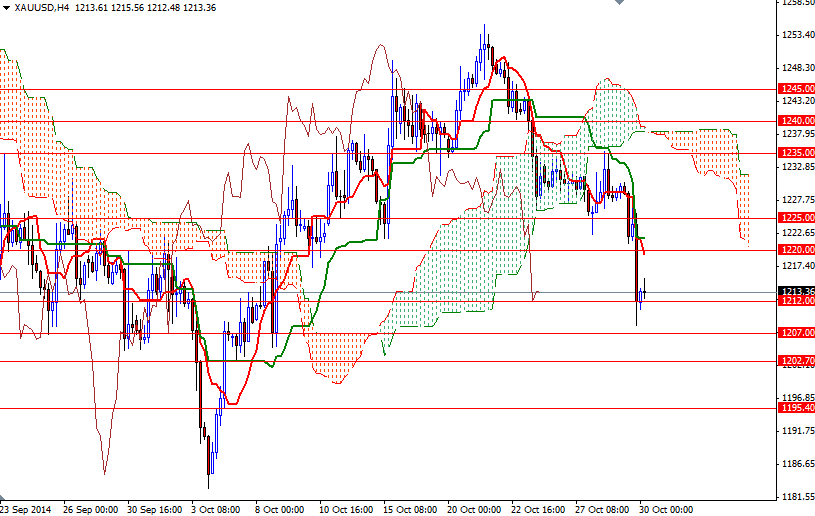

Yesterday's candle brought the market back below the Kijun-sen line (twenty six-day moving average, green line) on the daily chart. On the 4-hour time frame, we have a bearish Tenkan-sen line (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) cross. The Chikou span (brown line), which dropped below the cloud, also indicates that there is further downside risk. With that in mind, I will be keeping an eye on the 1212/10 area. If the bears penetrate this support, the 1205 level could be the next port of call. The area between the 1205 and 1202.70 levels has been supportive in the past so capturing this strategic point is essential for a bearish continuation. To the upside, the first important hurdle gold needs to jump is located at the 1220 level. The bulls will have to push the market above 1220 so that they can tackle the next barrier at the 1225 level.