Gold gave up some of its recent gains against the American dollar during Tuesday's session as the bulls failed to overcome the resistance around the $1240 level. Today the gold market remains steady during the Asian session as most investors are waiting for retail sales and producer price index figures. Meanwhile, stock markets are stabilizing, easing the demand for disaster insurance. Lately, the bulls took advantage of weakness in U.S. and Japanese equities and pushed gold prices above the $1225 level.

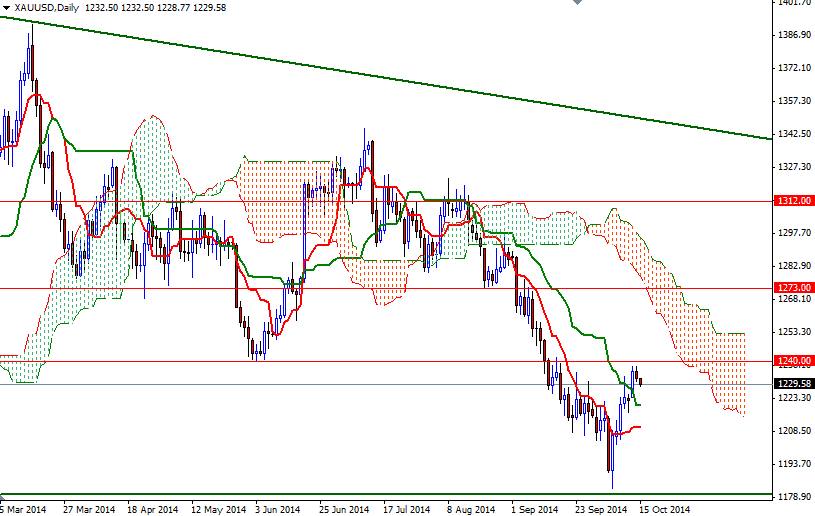

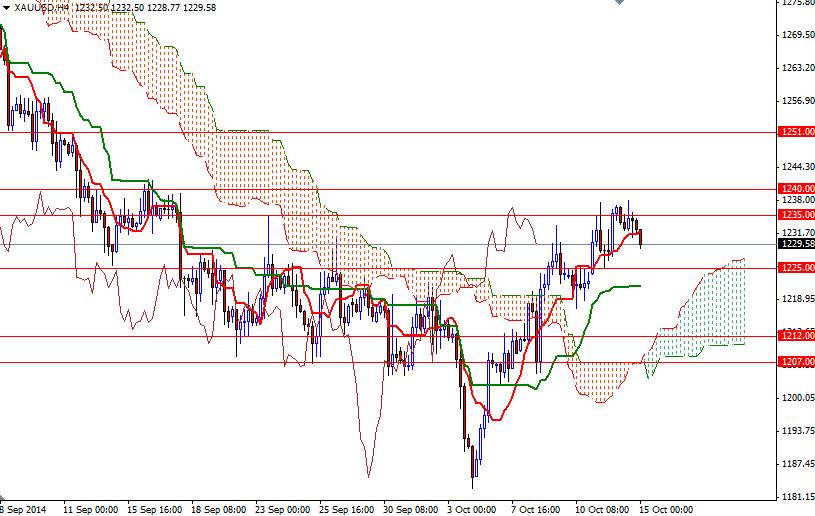

From a technical perspective, there are two things to pay attention at the moment. On the 4-hour time frame, gold prices are supported by the Ichimoku cloud and the Tenkan-Sen line (nine-period moving average, red line) is above the Kijun-Sen line (twenty six-day moving average, green line). On the other hand, the weekly and daily charts suggest that higher prices will continue to attract sellers over the medium-term.

As I pointed out in yesterday's analysis, resistance at 1240 which has established itself as an important level several times during the past two years will continue to remain as a key level to the upside. Breaking through this level could push prices back to 1251 and then 1258. If the bears continue to defend their camp at 1240 and the XAU/USD pair starts to retreat, it is very likely that we will see the 1225/1220 support being tested next. Closing below the 1220 level would make me think that 1212/1213.40 will be challenged afterwards.