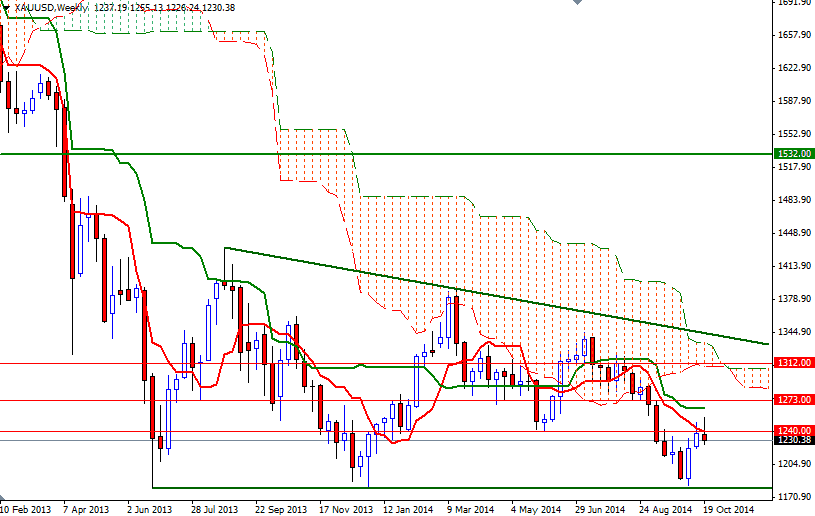

The XAU/USD pair declined 0.55% for the week and settled at $1230.38 an ounce on Friday as friendly risk environment and strength in the U.S. dollar dulled the precious metal's attractiveness. U.S. stocks continued to advance on the back of encouraging corporate earnings and a series of economic data which provided further evidence that the world's biggest economy remains on the right track. Lately, rising risk appetite and long-side profit taking have been weighing on the gold market.

Following a quiet Monday, the global economic calendar will be very active for the rest of the week. The Federal Reserve will be on market players' radars as a two-day meeting of its policy-setting committee kicks off this Tuesday. Although recent reports shows that lower prices attracted some serious buyers who want to diversifying their assets, I think the shiny metal's fate will depend how the Federal Reserve plays its cards. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 107984 contracts, from 85415 a week earlier.

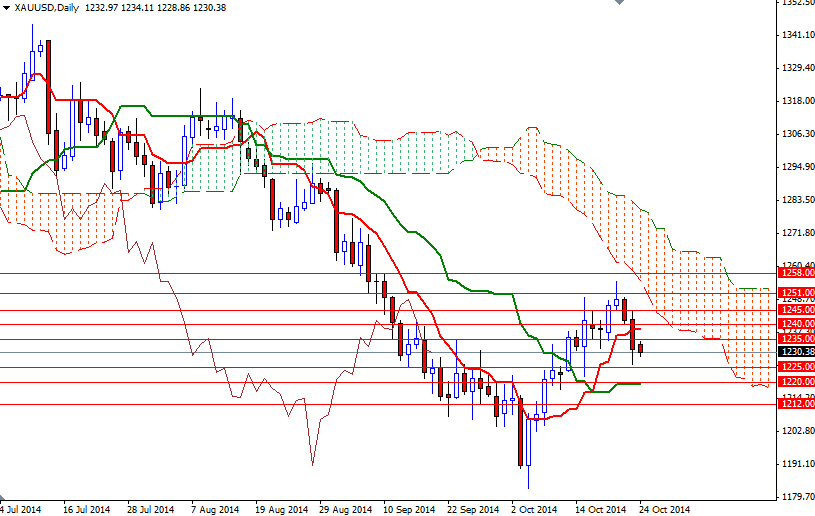

Technically, trading below the Ichimoku clouds on the weekly and daily charts suggest that there is more resistance to the upside at the moment. Since the daily cloud sits just above prices, we should pay close attention to the area it occupies (because the thicker the cloud, the less likely it is that prices will manage a sustained break through it). If the bulls don't want to lose the fight and retest the 1251 level, they will have to push the market above the 1245 level. But before that, expect to see some resistance at 1235 and 1240. However, if prices resume the bearish tone of the last few days and break below the 1225 level, then the 1220/19 support will be the next stop. Closing below this area on a daily basis would indicate that the XAU/USD pair is heading back to the 1212 level.