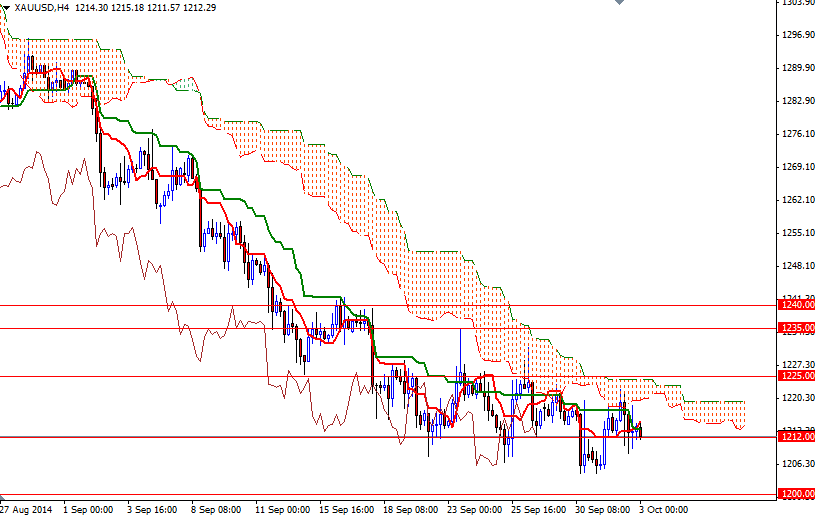

We have been going back and forth for the last nine days roughly between the 1235 and 1200 levels as the market simply had no real catalyst to push prices in either direction. During yesterday's session the XAU/USD pair (Gold vs. the American dollar) tried to pass through the Ichimoku clouds on the 4-hour time frame but encountered resistance as expected and pulled back to the 1212/08 area.

Data from the world's biggest economy was mixed. The Commerce Department reported that factory orders slumped 10.1% in August while s separate report released by the Labor Department showed that initial jobless claims dropped by 8K to 287K.

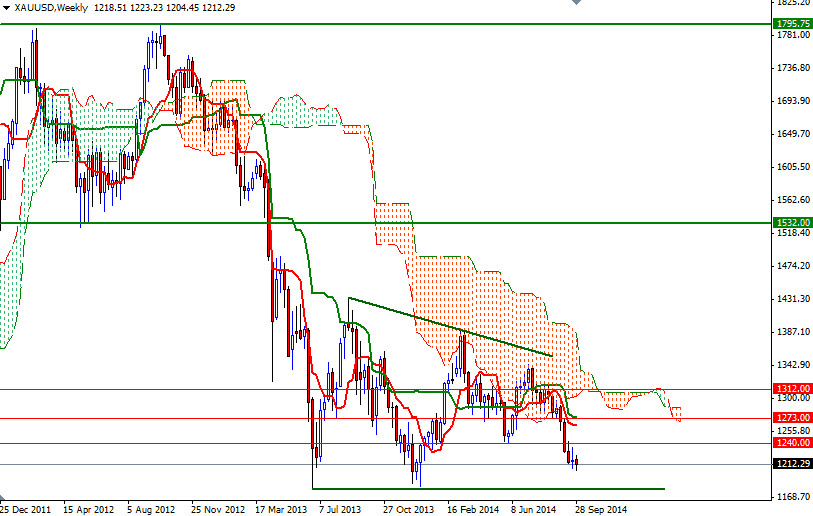

The market appears to be stable during the Asian session today but I highly doubt financial institutions will place larger bets ahead of U.S. jobs data. Candlesticks indicate absence of a significant momentum and from a technical point of view, I believe that the key levels to watch will be 1225 and 1200. If the bulls gain some traction and finally penetrate the 1225 resistance level, they may have a chance to reach the 1235/40 area. However, dropping below the 1200 level could create a certain amount of pressure on the market and increase the possibility of a bearish attempt to revisit the 2013 low of 1180.