Gold prices advanced on Tuesday, marking the first rise in five trading sessions, as traders took a cautious stance ahead of the U.S. Federal Reserve's latest policy announcement. The XAU/USD pair traded as high as $1235.37 an ounce after data released by the Commerce Department showed that orders for durable goods fell 1.3% but erased some of the initial gains on an upbeat consumer confidence reading. The S&P/Case-Shiller index of property prices was weaker than anticipated but the Richmond Fed's manufacturing survey easily beat expectations.

Even though there is broad consensus that the Federal Open Market Committee will end the asset purchases program, it seems like the markets are setting up for a dovish statement. Most expect the Fed to reaffirm its willingness to wait longer before raising interest rates. Anxiety over interest rates will grow until the fireworks begin and meanwhile it is unlikely investors will make big bets in either direction.

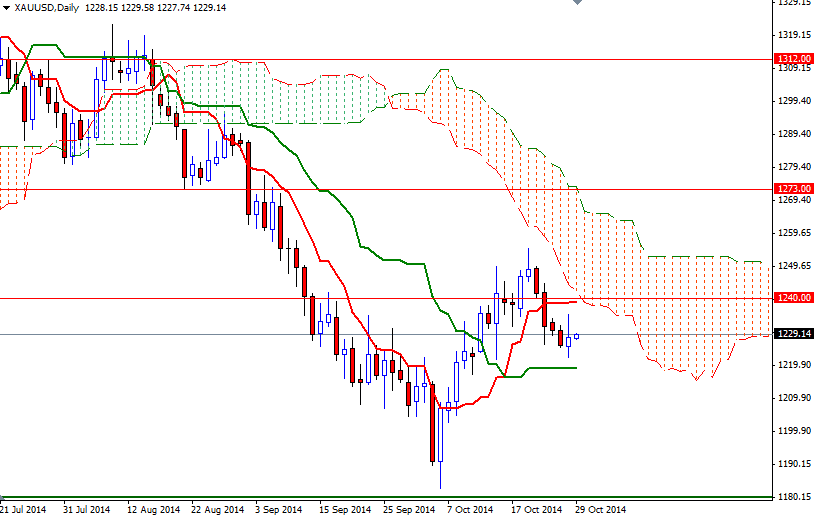

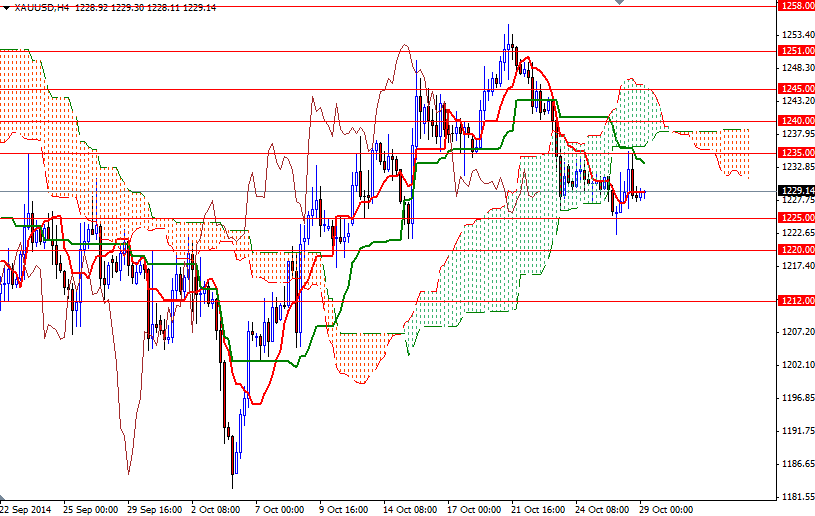

That means the 1235 level will continue to be resistive in the short term. The bulls need to capture this point so that they can gain enough momentum to reach the next barrier at 1240. If the market make a sustained break above the Ichimoku clouds (at least on the 4-hour chart), then the 1245 and 1251 levels will be the next targets. To the downside, there is an interim support at 1225. Only a close below the 1220/19 area -where the Kijun-sen line (twenty six-day moving average, green line) currently sits on the daily time frame- could give the bears the extra strength they need to reach the 1212 support level.