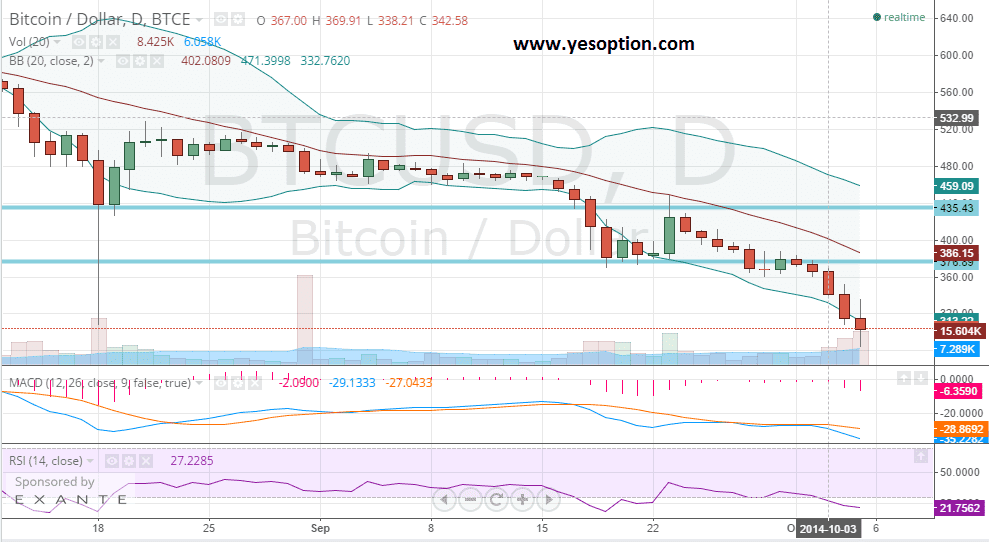

BTC/USD continued its downward spiral and is currently seen taking support near the $300 level. The selling pressure on the digital currency pair has pushed it below the important support zone at $340 on the back of strong volumes, which is a bearish indicator. The resistance for the BTC/USD on the upside comes near the $380 level and only a close above the level would make traders believe that a reversal is in place. It is imperative to say that the BTC/USD is below all-important daily moving averages. The relative strength index for BTC/USD is currently in the oversold zone but is showing no signs of a reversal indicative of the strong selling pressure. The momentum indicator for the BTC/USD has given a fresh sell signal and formed a lower high, which shows that momentum is truly in the hands of the bears at the current moment.

Paul Krugman, the well-known American economist had many followers of Bitcoin up in arms post an article he wrote very recently comparing the digital currency to a “con-job” and a right wing mail scam. Many believe that the economist had all his facts wrong and is trying his level best to confuse investors and followers of the digital currency. He believes is that Bitcoin is just merchandise, which is being sold to investors who have anti-government leanings. In other positive news for the Bitcoin, Greenpeace, the non-governmental campaigning organisation focussed on environmental issues confirmed that it would start accepting donation in the form of Bitcoin payments being seen as a huge positive. Greenpeace, in a statement said that Bitcoin allows them to promote free speech and independence.

Actionable Insight:

Short BTC/USD at current levels with a short-term target at $240 with a stop loss above $342

Long BTC/USD if it closes above $342 with a short-term target at $380.