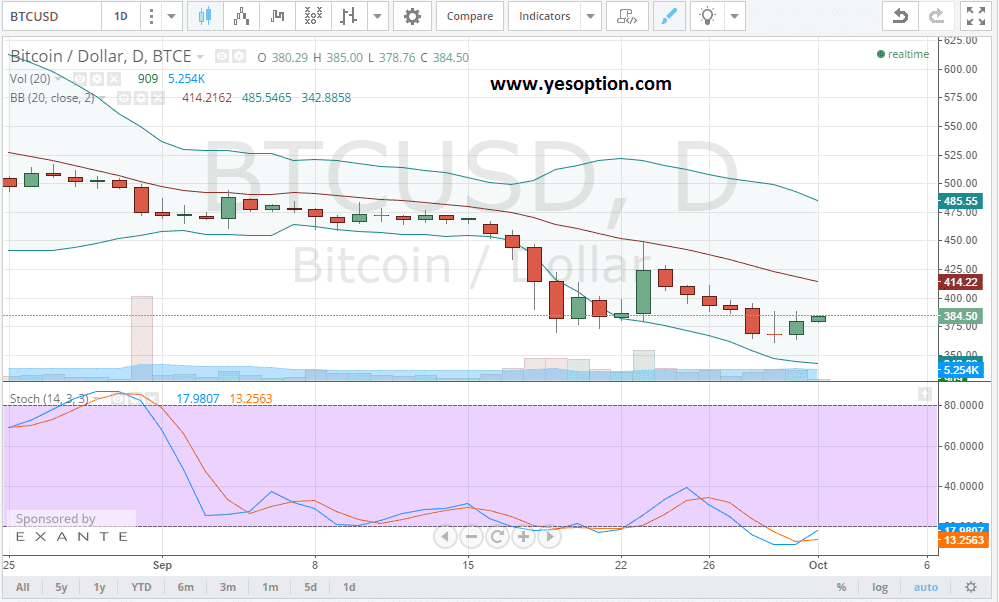

BTC/USD showed some strength in yesterday’s trading session bouncing back from the lows. The digital currency was unable to sustain at higher levels, which is a cause of concern. In the morning session, BTC/USD has opened higher and seems to have a bullish bias at the current moment. The resistance for the BTC/USD continues to remain at $400 and the support for it remains at $367.

Traders believe only a move above or below the aforementioned levels would provide for the next direction in the near term. The stochastic oscillator for the BTC/USD continues to remain under pressure confirming the strong negative bias. The BTC/USD continues to remain below all-important moving averages which are a bearish indicator. On the volume front, the upmove seen in yesterday’s trading session was on low a volume, which raises question marks about the strength of the rally.

News over the past few days about PayPal agreeing to incorporate Bitcoin as a valid form of payment has been a huge positive for investors. PayPal is said to sign up with companies like Coinbase to bring make Bitcoin easily accessible to the common person. Coinbase as a business model is more of a brokerage but it behaves like a bank as there are not many players in the marketplace, which allows Coinbase to play the role of an intermediary between investors who want to use Bitcoin as a form of payment for all their transactions. Coinbase, according to its founders has been setup with a sole purpose of making Bitcoin easily available to the masses and making sure about the long-term sustainability of the digital currency.

Actionable Insight:

Short BTC/USD if it closes below $367 with a short-term target at $320

Long BTC/USD if it closes above $400 for a short-term target at $441