Microsoft Corporation (NASDAQ:MSFT) reported that it will be providing unlimited storage space to all users who use Office 365. This shows the company’s renewed focus on adopting cloud services, which analysts feel is tremendously beneficial for the company going forward.

The worlds’ largest software maker reported results, which were far better than anyone expected. Microsoft experienced exceptional growth in the cloud storage business, allowing analysts to believe that newly appointed CEO, Satya Nadella is leading the company in the direction. To the surprise of many experts, Microsoft has been able to adapt itself to the constantly changing business environment. Analysts now believe that Microsoft is a good long term buy, as it has high dividend yields.

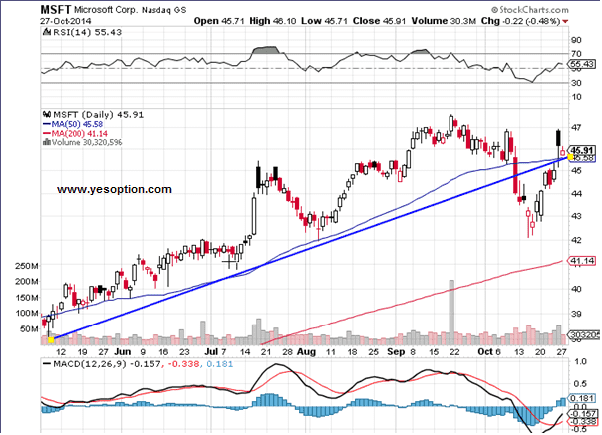

When looking at the daily chart for Microsoft, the stock has been in a strong upwards trend last year and currently trades above all of its daily moving averages. It additionally formed a very important support line near the $42.48 level, whereas its resistance line continues to be near the $48 level.

Recently, the stock breached below an all-important upward sloping trend-line, but strong buying interest quickly enabled it to move back above. Meanwhile, its momentum indicator is giving a fresh buy signal, which is indicative of a shift in momentum towards the buy side. Lastly, the relative strength index is situated in positive territory at the current moment, which is bullish in nature.

Actionable Insight:

Short Microsoft Corporation (NASDAQ:MSFT) if it closes below $45.58 for a short-term target at $42.00 with a strict stop loss above $47

Long Microsoft Corporation (NASDAQ:MSFT) if it closes above $47 for an intermediate target at $49.50 with a strict stop loss below $45.58