By: YesOption

Amazon.com, Inc. (NASDAQ:AMZN) has always been known as the company that changed the way people shopped. However, with the ever-changing face of retail shopping, brick and mortar giants like Target are trying to adapt to the needs of its consumers.

Target has now decided to offer free shipping to its consumers, a move that has made Amazon very famous with consumers. As per a statement released by Target, it firmly believes that the highly competitive retail space has forced the company to alternate its strategy to fit its consumer’s desires, and free shipping is a largely demanded need that should sway consumers

Amazon declined to comment on such recent developments, as it feels that it shouldn’t comment on every competitor’s move. Though, it does believe that these changes will enable consumers to have more power, something that Amazon has always tried to achieve.

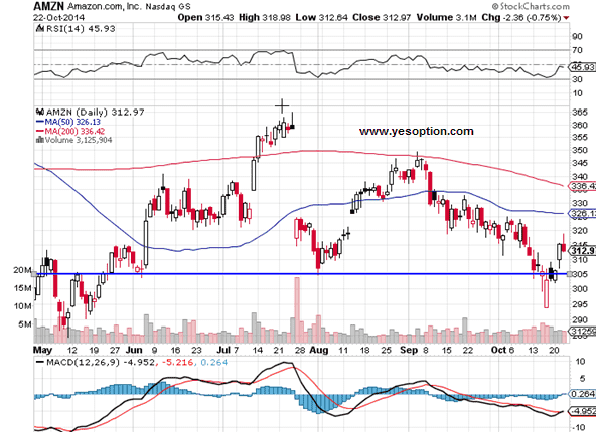

When looking at the daily charts for Amazon, although the stock has been in a strong uptrend over the last year, it witnessed steep selling pressure over the past few weeks, which forced the stock to fall below its daily moving averages. Amazon fell close to 1% in yesterday’s trading session, which many believe could have brought the current uptrend to a halt.

The momentum indicator for Amazon is situated in bearish territory and has not shown any signs of an imminent reversal, which analysts find troubling. The relative strength index is additionally showing signs of tapering, which is indicative of an impending downwards trend going forward.

Actionable Insight:

Short Amazon.com, Inc. (NASDAQ:AMZN) at current levels for an intermediate target at $295 with a strict stop loss above $319

Long Amazon.com, Inc. (NASDAQ:AMZN) if it closes above $319 with a short-term target at $326