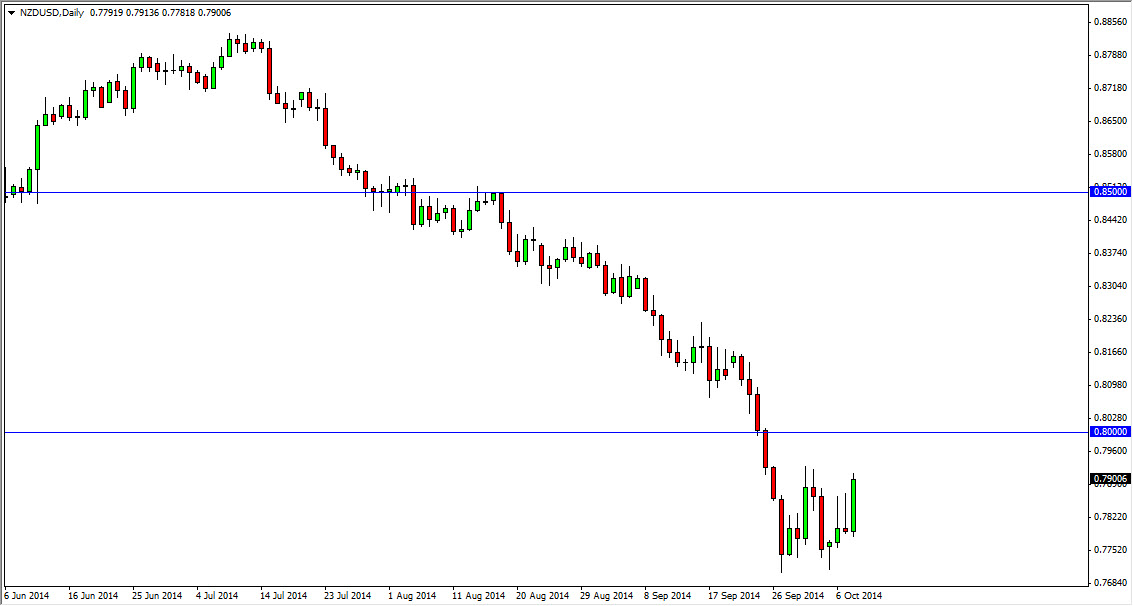

The NZD/USD pair rose during the course of the day on Wednesday, breaking the top of the shooting star from both Monday and Tuesday. That suggests that there is real buying pressure in this marketplace, and it’s only a matter of time before we test the next major resistance barrier, the 0.80 handle. That area is much more significant, and it appears that we are going to go into that area and perhaps press against the thick resistance barrier, which runs from 0.80 to the 0.81 level.

The New Zealand dollar has been sold off rather significantly recently, and as a result I feel that the downward trend should continue. Anytime this market rallies, you have to look at it as “value” in the US dollar. Because of this, every time this market falls it just simply shows that the US dollar strength should continue over the longer term.

The Royal Bank of New Zealand has been involved.

Remember, the Royal Bank of New Zealand has recently admitted to being involved in the marketplace, selling off the Kiwi dollar in order to bring the value of the currency down. They believe that the 0.68 level is more of a reasonable level for this pair to be at, and I believe that it’s only a matter of time before they get what they want. After all, the commodity markets aren’t exactly on fire, and the New Zealand dollar tends to be highly influenced by them.

On top of that, the market isn’t exactly one of the more liquid ones, so the fact that the central bank has been involved should push this market down rather rapidly. With that being the case, I believe that traders will be very cautious about hanging onto New Zealand dollars for any real length of time. I think that the 0.75 level will be targeted, followed by the 0.70 level, and the 0.68 level of course. If somehow we get above the 0.82 level, I think we could go as high 0.85, but I find it highly unlikely at this point in time.