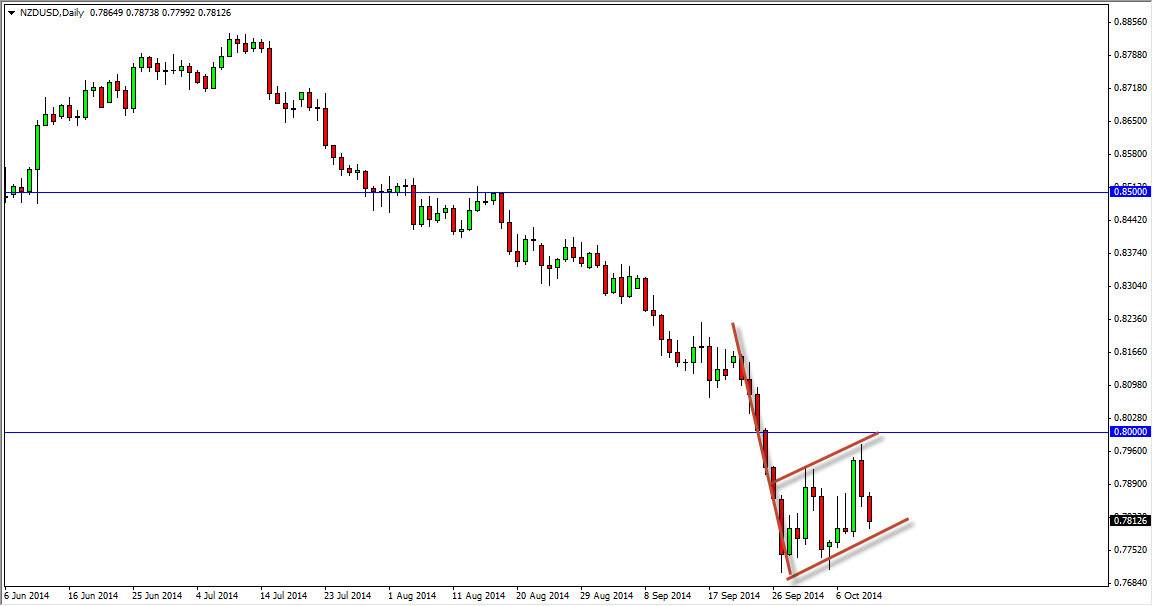

Looking at the NZD/USD pair, you can see that we did in fact drop a bit during the session on Friday, but it appears that we are forming a possible bearish flag. As you can see on the chart that I include with this article, there is the formation and we are most certainly in a downtrend to begin with. If we can break down below the 0.7750 level, I believe at that point in time the market will then drop to the 0.75 level first, and then very possibly the 0.70 level.

That being said, I feel that the market also will continue to go lower based upon the Royal Bank of New Zealand and it’s revelations recently that it has been stepping into the Forex markets and selling the New Zealand dollar. It also suggested that it was much more comfortable with a move to the 0.68 level in this marketplace, as the New Zealand dollar was overvalued. That being the case, I believe that it’s only a matter of time before the markets continue to drop significantly and you have to keep in mind that the NZD/USD pair isn’t as liquid as many of the other major pairs. Because of that, central bank intervention will certainly move the markets, just as the mere threat of intervention well.

Commodities look vulnerable

At this point in time, commodities look very vulnerable in general. With that being the case, the markets will do very little to boost confidence and commodity currencies such as the NZD. Because of that, I believe that this market will continue to be one that you can sell every time it rallies, as well as breaks down. I do believe that the 0.68 level will be reached, or at least somewhere near it, perhaps the 0.70 handle. Either way, this means that the market can only be sold at this point in time, and I look at the 0.80 level as been extraordinarily resistive, keeping the market down. Most people will not step up against the central banks, and that’s essentially what they would have to do in order to start buying this pair.