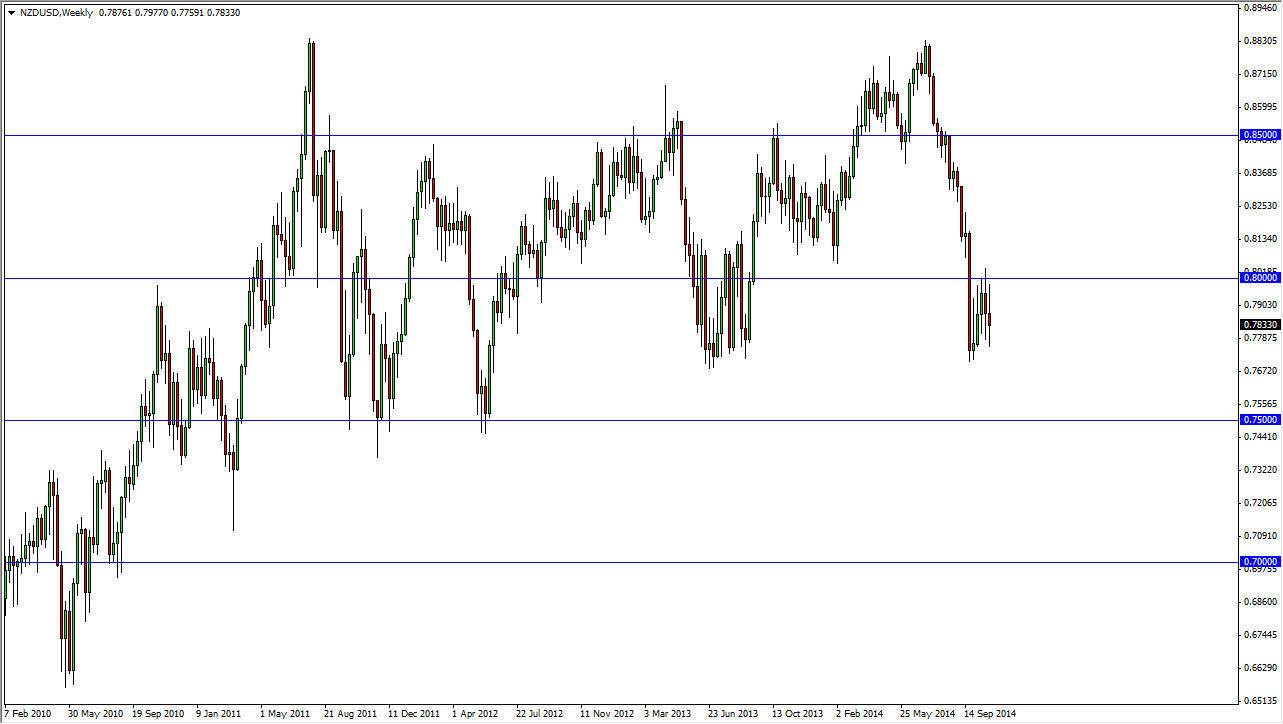

The NZD/USD pair is rapidly becoming one that I am enjoying trading. I believe that the central bank out of Wellington will get its wish, a much lower priced Kiwi dollar. Recently, members of the Royal Bank of New Zealand has suggested that they leave the market should be closer to the 0.68 handle, and I see nothing on this chart that suggests it could happen.

With that being the case, I am looking to sell rallies going forward, and I do believe that the 0.80 level should continue to offer resistance. Every time we get close to that level, I would expect this market to find plenty of bearish pressure, and that the sellers would step into the marketplace and push the Kiwi down.

The recent action has been rather bearish, and the fact that the Royal Bank of New Zealand has actually admitted to coming into the marketplace and selling the New Zealand dollar directly of course is going to do a lot to bring down the value. Because of this, it’s likely that the New Zealand dollar will continue to fall, and I am selling rallies going forward.

0.77

The 0.77 level should be the gateway to much lower prices, probably heading down to the 0.75 level first, and then ultimately the 0.70 level. I think that 0.75 is probably a realistic target for the month of November, as I believe the bearish pressure will continue to weigh upon the New Zealand dollar.

On top of that, you have the Federal Reserve which is exiting the quantitative easing game now, and that of course will drive money to the US dollar in general. I don’t think that the commodity currencies will do well anytime soon, and now that we are getting towards the end of the year, I think that the lack of liquidity will make the New Zealand dollar a currency that could move rather quickly. Remember, although this is a major pair, the reality is that the liquidity in the NZD/USD pair is nothing like the other majors.