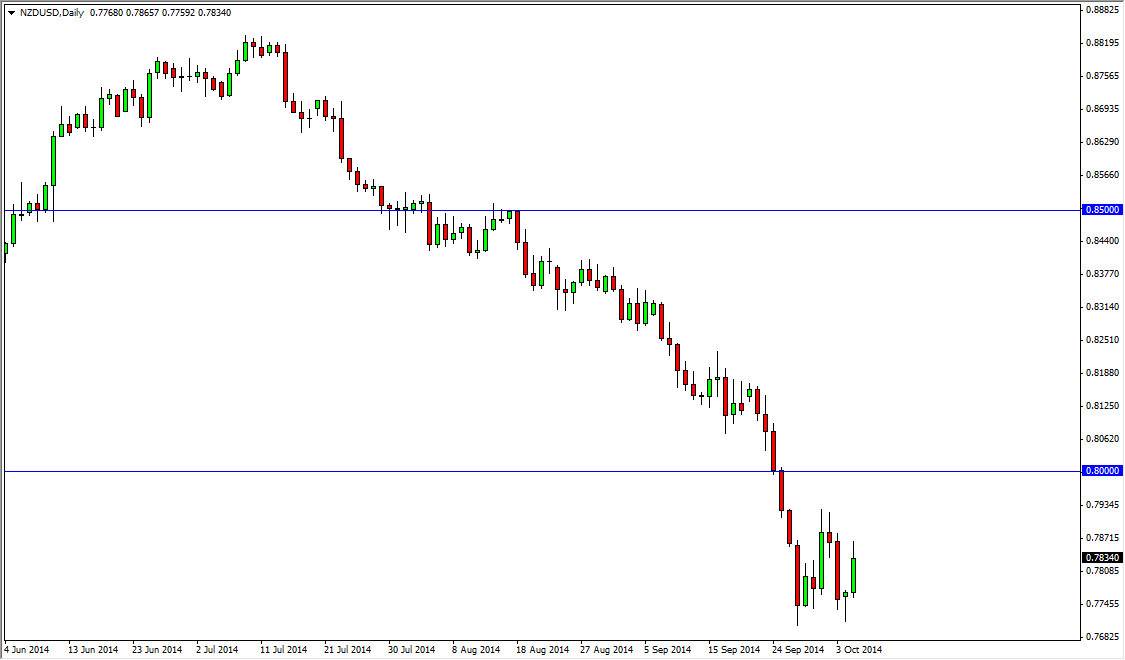

The NZD/USD pair rose during the session on Monday, but I feel that we are still well within the consolidation area that we have been in for some time. The 0.80 level above it should continue to be resistive, and the long-term charts for the New Zealand dollar do not look healthy at all. On top of that, we have a central bank in Wellington that is looking to sell the Kiwi dollar again and again. In fact, the Royal Bank of New Zealand has already admitted to shorting the NZD/USD cross, and as a result I believe that the market should continue to respect its wishes.

The 0.75 level below is a longer-term support area, but quite frankly I think that the central bank will get its wish: a move down to the 0.68 level, or at least close to a given enough time. I continue to sell the New Zealand dollar retirement rallies, and have absolutely no interest whatsoever in buying it. I really don’t think that we have a proper buying opportunity until we get above the 0.8250 level, something that I don’t expect to see anytime soon.

Don’t fight the trend

The US dollar is the strongest currency out there after all, and in a world where commodities or selling off, I just don’t see the New Zealand dollar faring well given enough noise in fear out there. I think that it’s only a matter of time before we break down, and I love the idea of selling rallies as they appear, as the short-term traders I’m sure.

The Asian economic numbers have in exactly been stellar recently either, and of course the New Zealand economy is heavily influenced by Asia. With that, I see that we just have no real likelihood of significant rallies over the longer term, and as a result I remain very bearish of this market going forward, and think that we will continue to see bearish pressure all the way through the rest of the year, and possibly into the spring of next year.