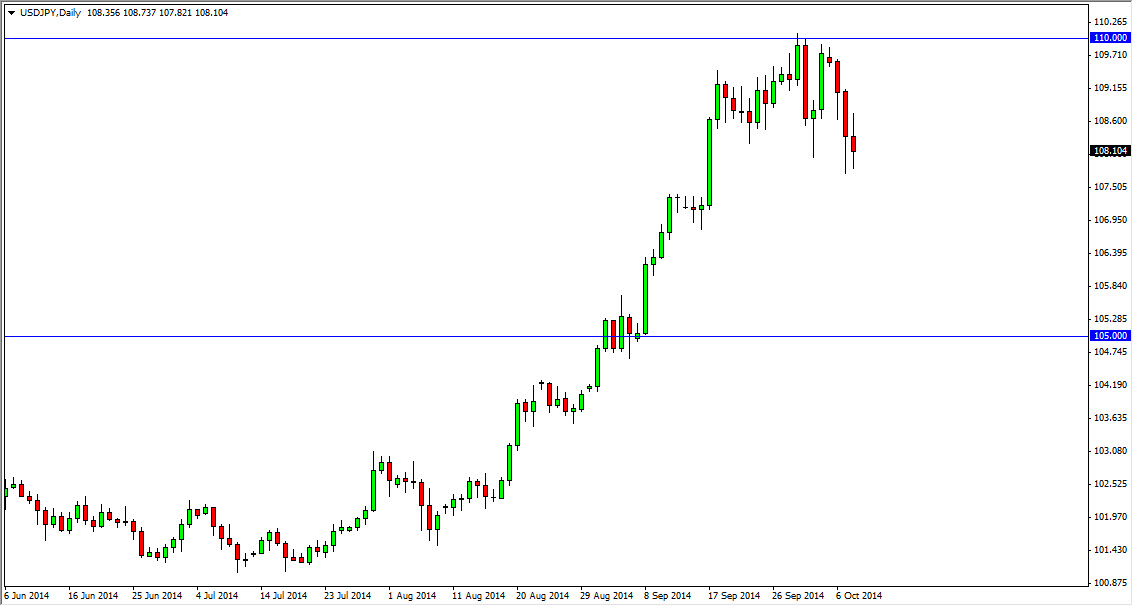

The USD/JPY pair fell a bit during the session on Wednesday, testing the 108 level for support. However, this market is most certainly in an uptrend, and there’s no reason to think that it’s going to change anytime soon. Ultimately, I think that the market will continue to go higher, breaking above the 110 level and perhaps heading to the 115 level given enough momentum and time.

I think that any pullback at this point is simply going to be a nice buying opportunity as it should represent value in the US dollar. I think that support runs all the way down to the 105 level, but let us not forget that the 108 level is supportive, just as the 107 level is. I think that a supportive candle in it any of these three levels is reason enough for going long, and I also believe that the 105 level is essentially the “floor” in this marketplace. After all, the US dollar continues to strengthen against most assets, and the Bank of Japan continues to work against the value of the Yen.

Multi-year uptrend?

I believe that we could possibly be seen the beginning of a multi-year uptrend, and I think that the US dollar will continue to strengthen overall, and this will be especially true against the Japanese yen as the Bank of Japan will continue to keep a very easy monetary policy. With that, I think that every time this market dips, there will be buyers stepping into it in order to push the markets much higher. This could be a return to the old glory days of the “carry trade”, as it was as simple as buying the USD/JPY every time it fell and hanging on in order to make profits.

Unfortunately, there isn’t some type of swap that you can make money off of at the end of each day, so we don’t really have a real carry trade going here, but eventually there will be. Remember, the markets do tend to try to anticipate what’s about to happen, and I think that’s exactly what is going on now.