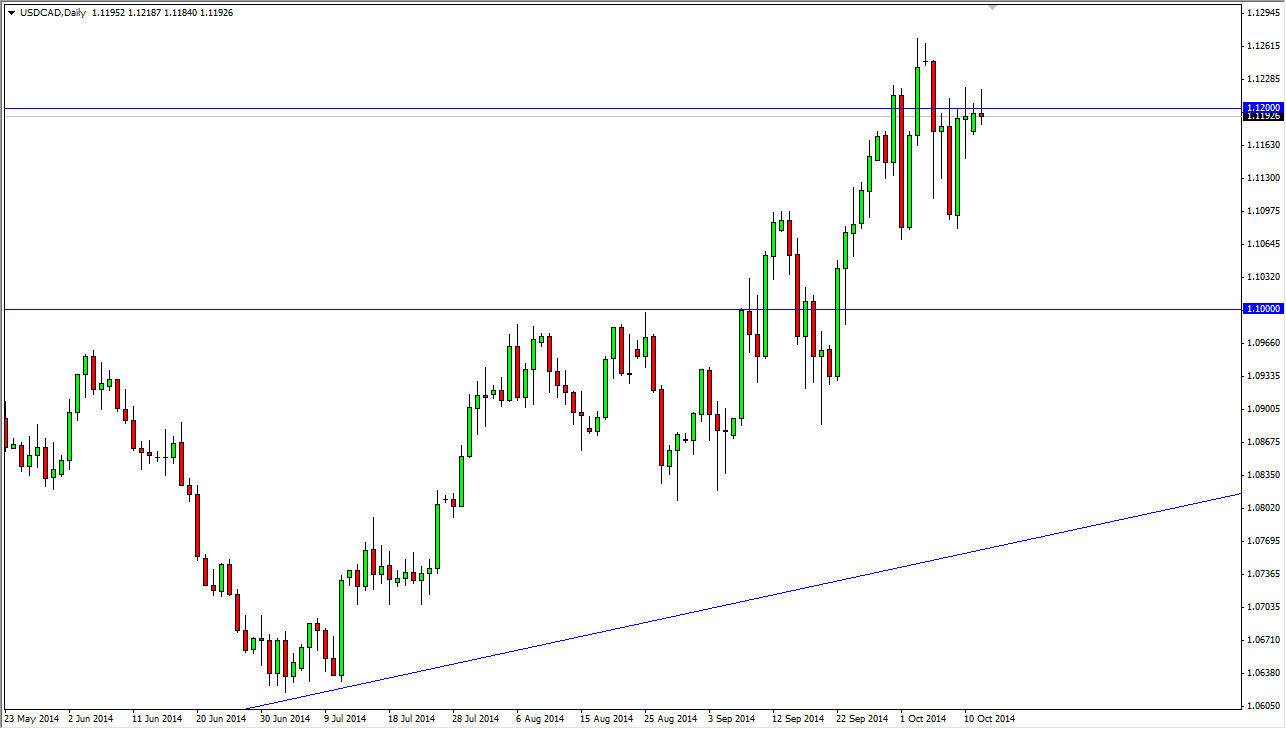

The USD/CAD pair initially rallied during the course of the day on Monday, as the US dollar continued to show strength against its Canadian counterpart. However, the 1.12 level is a significant resistance barrier, and as a result the sellers step back into the marketplace, pushing the value of the US dollar down slightly. At the end of the day, we had a shooting star which of course is a bearish sign, but I do not believe that this is the beginning of some massive selloff. Quite the contrary, I believe that this is simply a market that is trying to find enough strength to break out and continue going much higher.

I believe that a break of the bottom of the range from the Monday session, although a classic sell signal, does not have this market falling strong enough to take advantage of it. On the other hand, I believe that it’s probably easier to simply let the market pullback to roughly 1.11, and serve buying again as we eventually will build up enough momentum to break out.

Petroleum prices are working against the Canadian dollar

The oil markets simply are not helping the Canadian dollar at this point, as the US dollar continues to strengthen overall, and demand for oil continues to drop. In an environment where economic strength becomes an issue globally, the oil markets are very sensitive to that, and then by extension the Canadian dollar. This is especially true against the US dollar, as most traders will use it as a proxy for the oil markets.

That being said, this pair does tend to be rather choppy so I think that even if we break out to the upside, it’s going to be a back-and-forth affair all the way up to the 1.15 handle. Remember, the two economies are highly intertwined, as the Canadians send 85% of their exports into the United States. By its very definition, that means that this pair rarely has a smooth move in either direction. That being said though, I still believe that we are firmly in an uptrend.