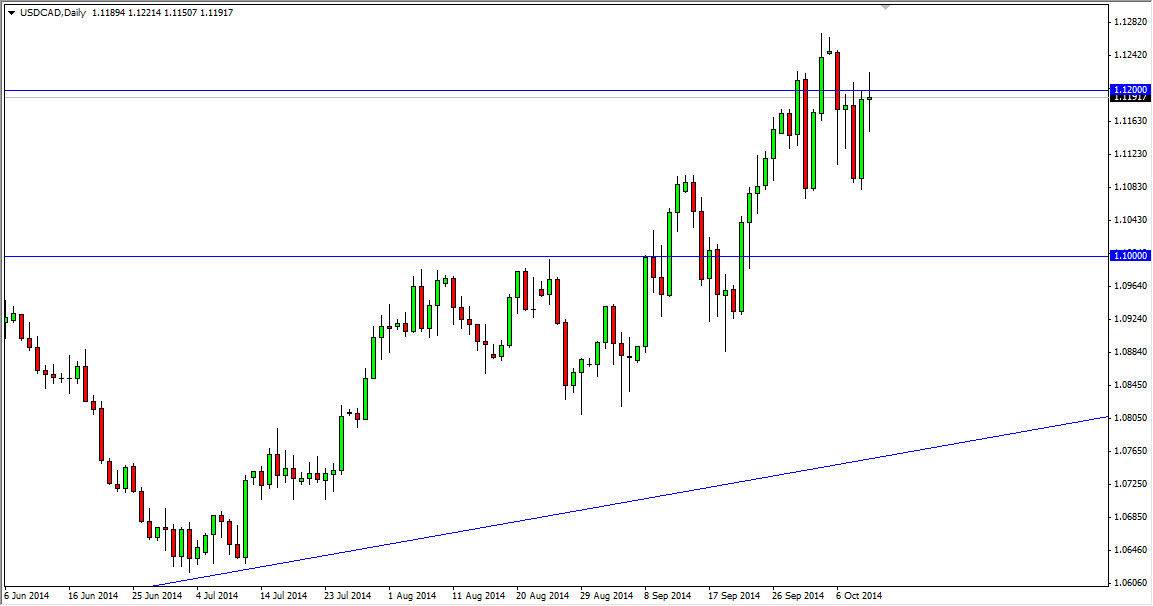

The USD/CAD pair went back and forth during the course of the session on Friday, testing the 1.12 level for resistance. It did in fact hold, but I feel it’s only a matter of time before we do break out to the upside. Because of this, I am waiting to see a couple of different possibilities, before start going long.

A break above the top of the range for the session on Friday would be enough for me to start buying this market, as I believe that the US dollar will continue to be one of the more favored currencies around the world. I don’t really want to sell this market, and I do believe that this point in time that if we do fall from here, there will be enough buying pressure below to push the market higher again.

The market has certainly been very bullish on the whole since June, and I feel that the uptrend is probably something that we are going to see continue for some time. With that, this market continues to be one that we can “buy on the dips”, as the US dollar should continue to bring in plenty of interest.

Oil isn’t helping

The oil markets certainly are not giving a hand to the Canadian dollar, and therefore one of the larger fundamental reasons for buying the Canadian dollar seems to be evaporating. With that, although the Canadian dollar will more than likely be strong against most currencies, the US dollar being a bit different though, as the US economy is stronger than most.

Ultimately, I think that this market will go higher over the longer term as well, and that we will hit the 1.15 level given enough time. I also believe that pullbacks at this point in time should be buying opportunities as it would look at the US dollar as being on sale at that point in time. I don’t see any reason whatsoever to sell this market, at least not until we get below the 1.09 level, something that does not look very likely at this point in time.