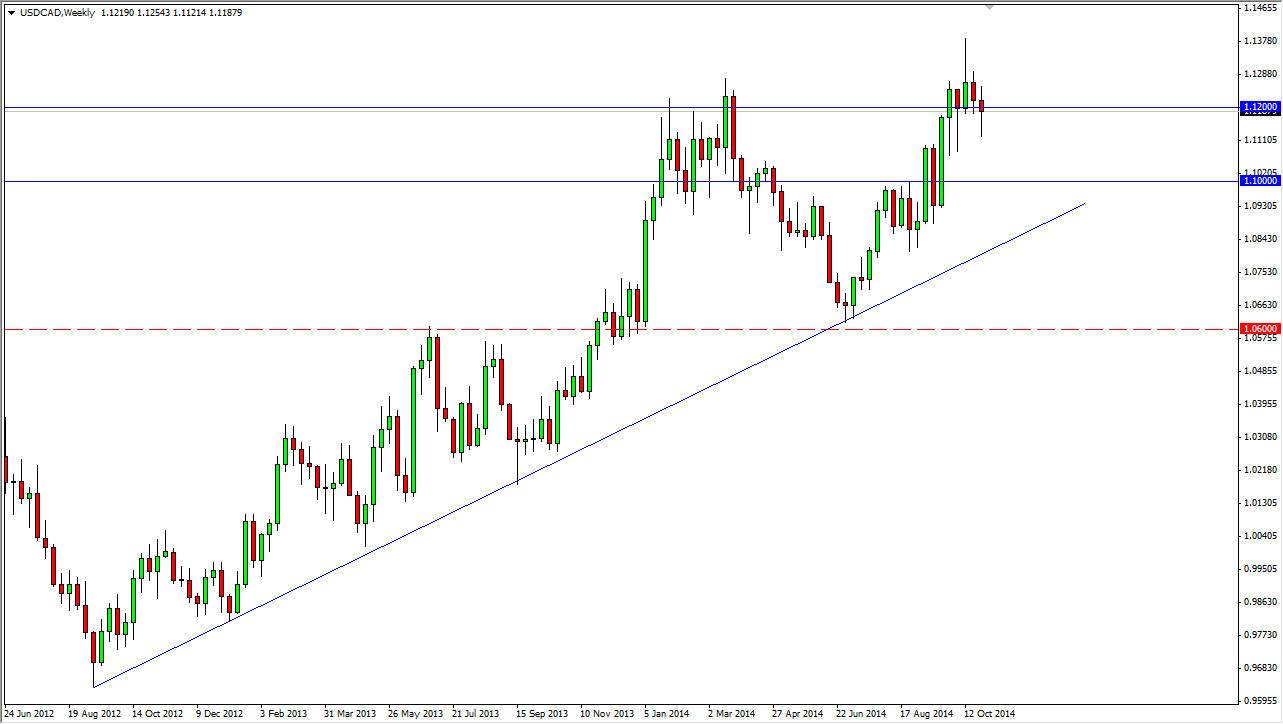

The USD/CAD pair has bounced around the 1.12 level for the last several weeks. I do believe that ultimately we will continue the uptrend that we have seen for some time now, but quite frankly we are at pretty significant levels when it comes to the oil markets. After all, the WTI Crude Oil market is currently sitting at roughly $80. That of course is a large, round, psychologically significant number, and as a result it’s likely to attract a lot of support. It’s going to take some significant momentum to break down below there, and once it does I believe we will see the Canadian dollar fall apart.

It’s not until then that we will get the move though, so really what I’m looking at in this pair for the month of November is to simply buy pullbacks on short-term charts. Eventually, I will get lucky and we will have the breakout to the upside. I think that the market will more than likely move to the 1.14 level several times, before finally building up enough momentum to break out which should coincide with a breakdown in the oil markets.

US dollar remains firm

The matter what happens, I believe that the US dollar will continue to be one of the favored currencies around the world, and although the Canadian dollar will get a bit of a boost because of its status is a North American currency, I find it very difficult to imagine that it will suddenly take off against the US dollar without something significant happening in the oil markets. Because of this, I remain very bearish of the Canadian dollar at least against the greenback, meaning that I expect this pair to go higher.

I think by the end of the year we could very easily see a 1.17 level print, but I would not be surprise at all to see 1.15 tested during the month of November. This pair does tend to grind sideways for long periods of time though, so be patient if you are going long of this market. As far selling is concerned, I’m just not interested into we break well below the 1.10 handle.