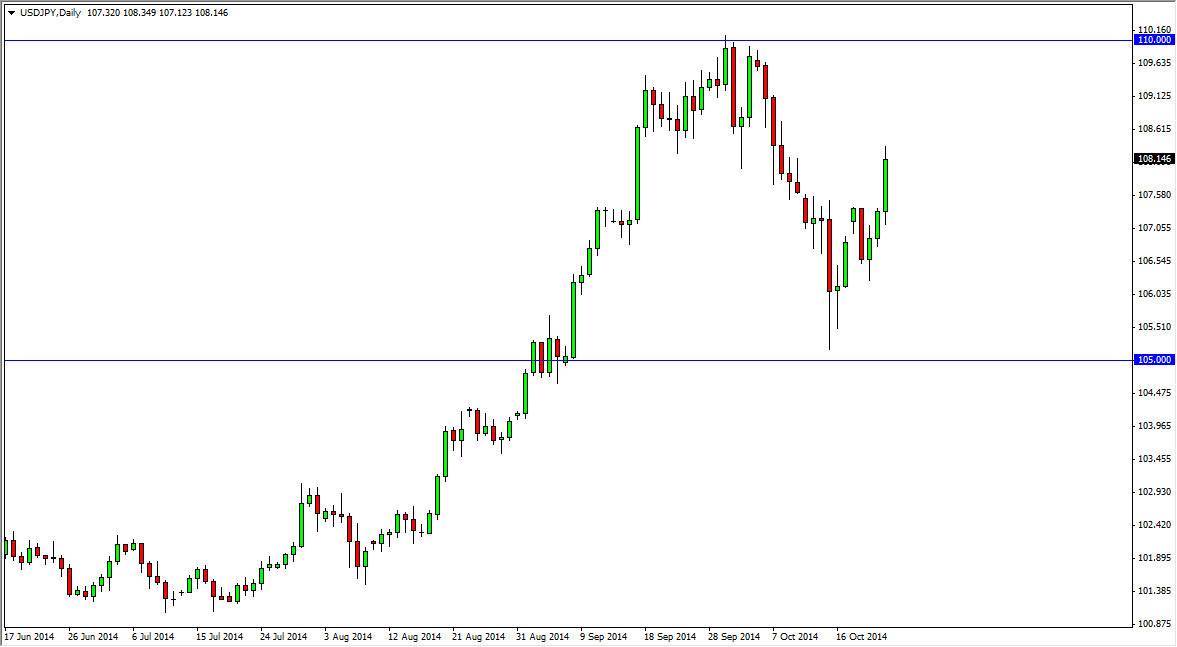

The USD/JPY pair broke out above the 107.50 level during the session on Thursday, which of course is a very significant resistance barrier. Because of that, it appears of this market is ready to continue going higher, even though anticipate the 109 level to be resistive as well. There is a lot of noise between there and the 110 level, so wouldn’t surprise me at all to see this market struggle but I believe that ultimately we will in fact go to the 110 level. That area should be resistive, but ultimately I think it’s only a matter of time before we break out above there and head to the longer-term target of 115 that I have.

I believe that pullbacks will continue to offer buying opportunities as well. Because of that, I will look to short-term charts to continue to add to this position, especially once we break out above the aforementioned 110 handle. I think that the markets will continue to favor the US dollar overall, especially considering that the Bank of Japan is working against its own currency so drastically.

Japanese yen

The Japanese yen continues to be sold off against most currencies, and with a relatively “safe” attitude that the markets have towards the US dollar, I believe that this market will continue to show weakness in the Yen. Ultimately, the market seems to be focusing on Japan and not so much the United States as it is pretty much accepted that the US economy is doing better. With that being the case, I don’t see any reason why this market will sell off for any significant amount of time, and it will continue to offer value in the US dollar.

I believe that the 105 level is the “floor” in this market, as it certainly has been massively resistive and supportive in the past. I don’t see that changing anytime soon, so unless we break down below there, I am most certainly bullish of this market. Short and long-term traders both will continue to push it higher in my opinion.