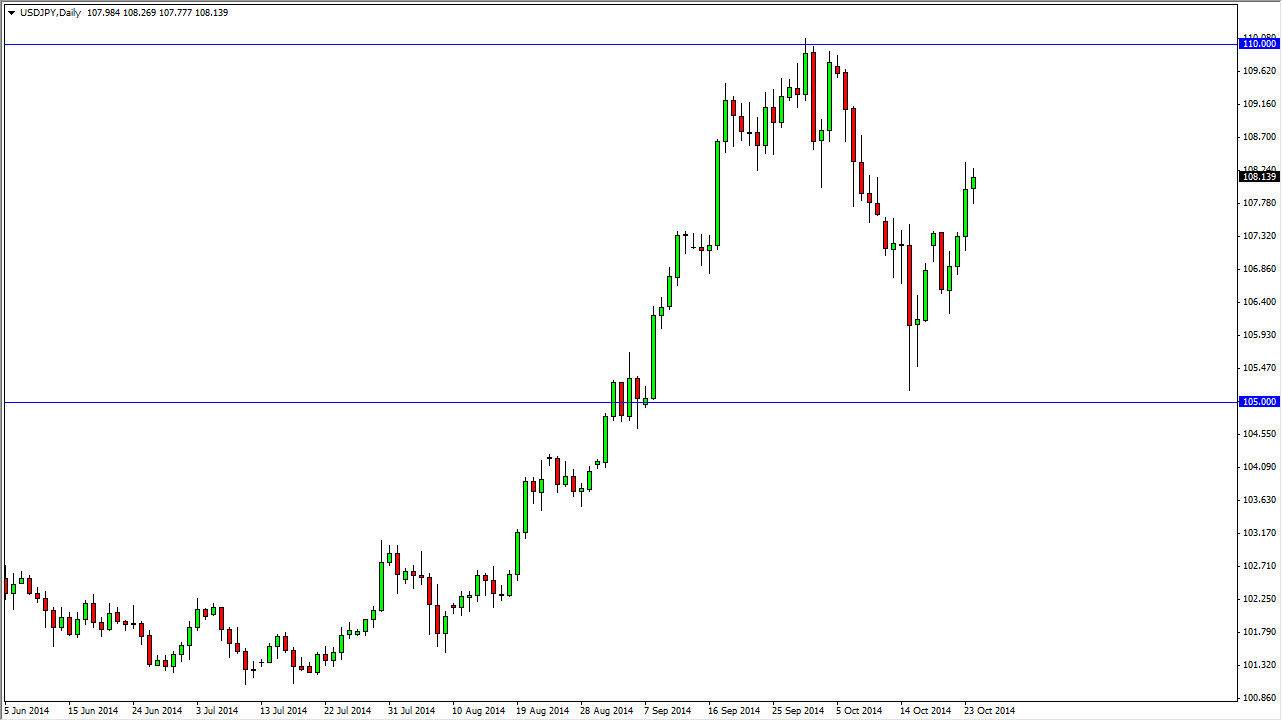

The USD/JPY pair continues to find buyers every time he drops, and the Friday session was of course not any different. Ultimately, the market should continue to be a “buy on the dips” type of proposition, and I do think that is going to be the way this market continues going much longer term and far into 2015.

The US dollar should continue to strengthen against most currencies, as the Federal Reserve continues to step away from the quantitative easing game. On the other side the Pacific, you have the Bank of Japan which of course is not only very loose in its monetary policy, but could even continue to accelerate its monetary policy in order to devalue the Japanese yen, as well as lift the overall value of the Nikkei, as it had started to struggle recently.

One-way trade for longer-term traders

In my opinion, this is a one-way trade for longer-term traders as the market should simply continue to go much higher, favoring the US dollar as it is one of the most favored currencies on the planet right now. I also believe that eventually the interest-rate differential will widen quite a bit and favor the US dollar in the bond markets, which is a major driver of this particular currency pair.

I don’t see any chance of selling this market until we get well below the 105 level, which currently has acted as a “floor” in this marketplace. On top of that, I believe that the Bank of Japan would in fact get involved if this market broke down below that level as they would at the very least start to verbally intervene, if not flat out step in and start intervening in this marketplace directly.