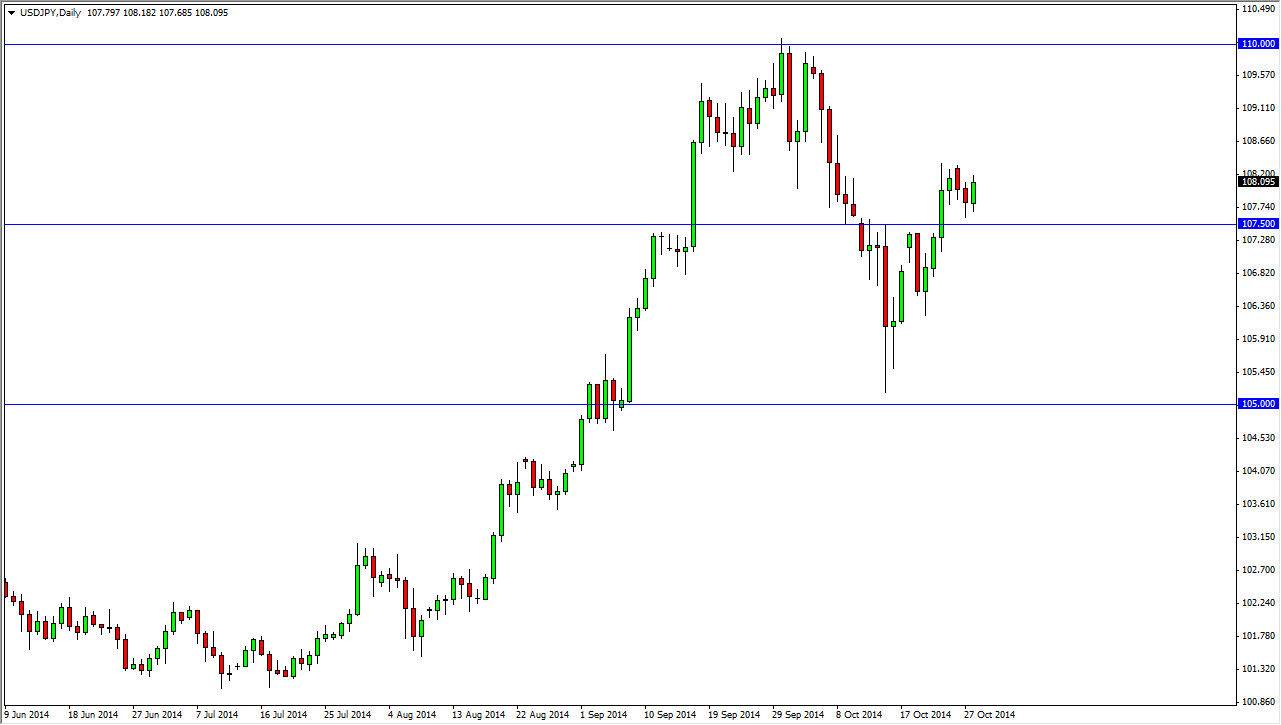

The USD/JPY pair found a bit of support during the Tuesday session, using the 107.50 level as a springboard. We broke the top of the hammer from the Monday session, and that of course is a very positive sign. At the end of the day though, we have to keep in mind that the Federal Reserve has an interest rate decision today, as well as a statement that being released. With that being the case, it’s very likely that we will get a bit of volatility in this particular pair during the session.

I believe that the 107.50 level will be pretty supportive, so if we get some type of knee-jerk reaction based upon the statement that drives his pair lower than they are, I will be immediately looking for some type of supportive candle in order to get involved in this market and take advantage of what would be essentially “value in the US dollar.”

Bank of Japan

The reality is that the Bank of Japan is probably one of the most dovish central banks in the world, as it has typically been for decades. The Bank of Japan continues to offer very accommodative monetary policy, and will not be outdone by the Federal Reserve, even if the Federal Reserve does find itself in a very dovish stance today. Ultimately, the Bank of Japan will have the value the Yen much lower, which of course means driving this pair much higher.

This pair still looks to target the 110 level in my opinion, and that has not changed at this point in time. I believe that ultimately this market will find that level, but it’s likely that we will see a bit of volatility. On top of that, I believe that the 110 level gets broken to the upside and we eventually head to the 115 level. Don’t get me wrong, going to take a long time to do that and I believe that it’s probably going to be closer towards the end of the year before we see that. That being said though, I have no interest in selling.