USD/JPY Signal Update

Yesterday’s signal was not triggered as although the price did hit 107.00, there was no bullish price action there.

Today’s USD/JPY Signal

Risk 0.75%

Entries may only be made today until 5pm New York time and then between 8am Tokyo time until 8am London time tomorrow (Wednesday)

Short Trade

Go short following bearish price action on the H1 time frame after a first touch of 108.00.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

USD/JPY Analysis

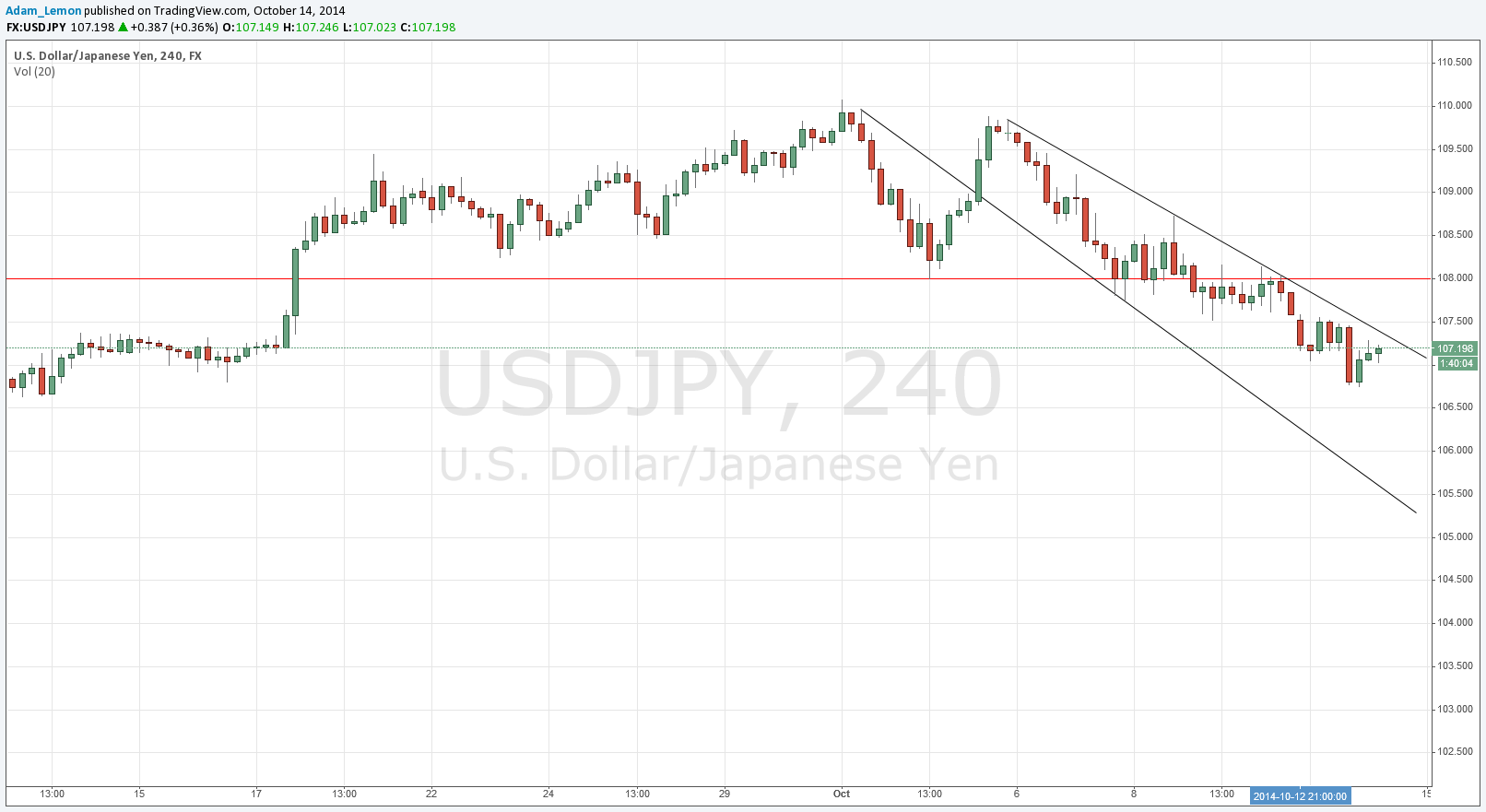

The strengthening of the JPY seems to be continuing so far this week. There are no flipping support or resistance levels anywhere to be seen below us, which can be a common situation with JPY pairs. The best technical observations that can be made are firstly that there is JPY strength everywhere and secondly, that this pair is falling within a bearish channel, as shown on the chart below.

There is flipped support to resistance confluent with the round number at 108.00. Although a rise to this level would be a breach of the bearish channel, it should still be a good area at which to seek a short provided it is confirmed by bearish price action.

There are no high-impact data releases concerning either the JPY or the USD scheduled for today. For this reason, it is likely to be a quiet day today for this pair.