USD/JPY Signal Update

Yesterday’s signal expired without being triggered as the price never hit 108.00.

Today’s USD/JPY Signal

Risk 0.75%

Entries may only be made today until 5pm New York time and then between 8am Tokyo time until 8am London time tomorrow (Thursday).

Short Trade

Short entry following bearish price action on the H1 time frame after a first touch of 108.00.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to ride ensuring there is no risk left in the trade.

Long Trade

Long entry following bullish price action on the H1 time frame after a first touch of 106.50.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to ride ensuring there is no risk left in the trade.

USD/JPY Analysis

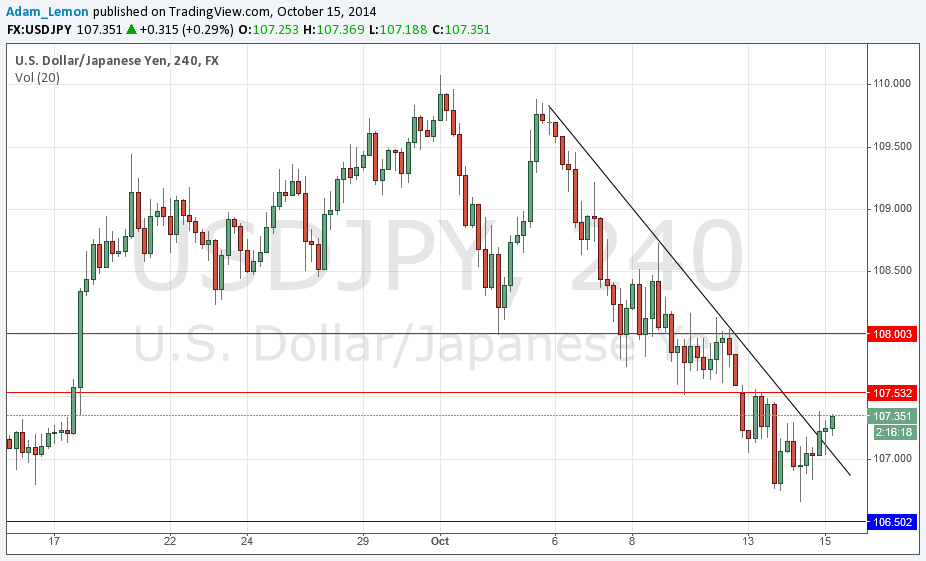

The bearish trend line which I highlighted yesterday has been broken by a few bullish candles, which is suggestive that we will not get a move up, possibly to the potential resistance level I also highlighted at 108.00.

The general recovery in the USD across the board yesterday has helped to fuel this. There may also be a pullback in recent JPY strength going on.

The chart also suggests however flipped support to resistance close by the key psychological number of 107.50, so it might be that we find it hard to break through that level. However I am not looking for a short trade there as it looks too recent and congested to me to be safe enough.

There are no high-impact data releases concerning the JPY scheduled for today. Regarding the USD, there will be several data releases later at 1:30pm London time: Core Retail Sales, Retail Sales, and PPI. Therefore the New York session is likely to be the most active time for this pair.