USD/JPY Signal Update

Last Wednesday’s signal was not triggered as although 106.50 were hit, there was no following bullish price action at the level.

Today’s USD/JPY Signal

Risk 0.75%

Entries must be made either before 5pm New York time or between 8am Tokyo time and 8am London time tomorrow (Tuesday).

Short Trade

Go short following bearish price action on the H1 time frame after a first touch of 107.50.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

USD/JPY Analysis

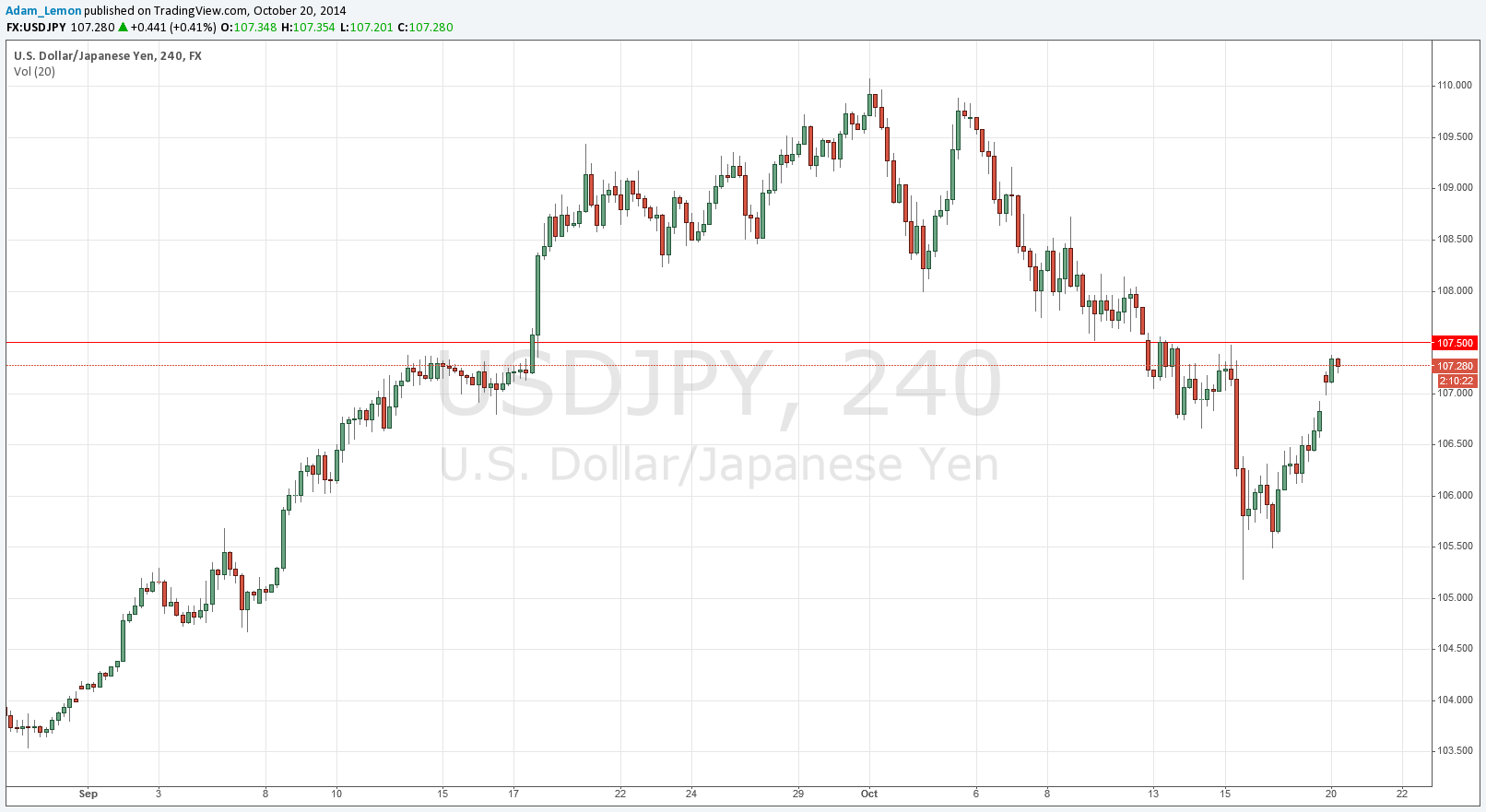

Since my previous forecast some days ago there has been a lot of market turbulence which saw this pair fall all the way down close to 105.00 before rising again quite sharply. The action has quietened down but natural feel would be for this pair to continue to rise and probably chop around in decreasing swings between 106 and 108 or 109.

The problem with this scenario is that the only natural flipped support or resistance level currently visible on the H4 chart, which is shown below, is not far above us confluent with the key psychological level at 107.50. If the next touch of this level sees bearish price action, it should be a good area at which to seek a short trade.

There are no high-impact data releases concerning either the JPY or the USD today. Therefore it is likely to be a quiet day for this pair.