USD/JPY Signal Update

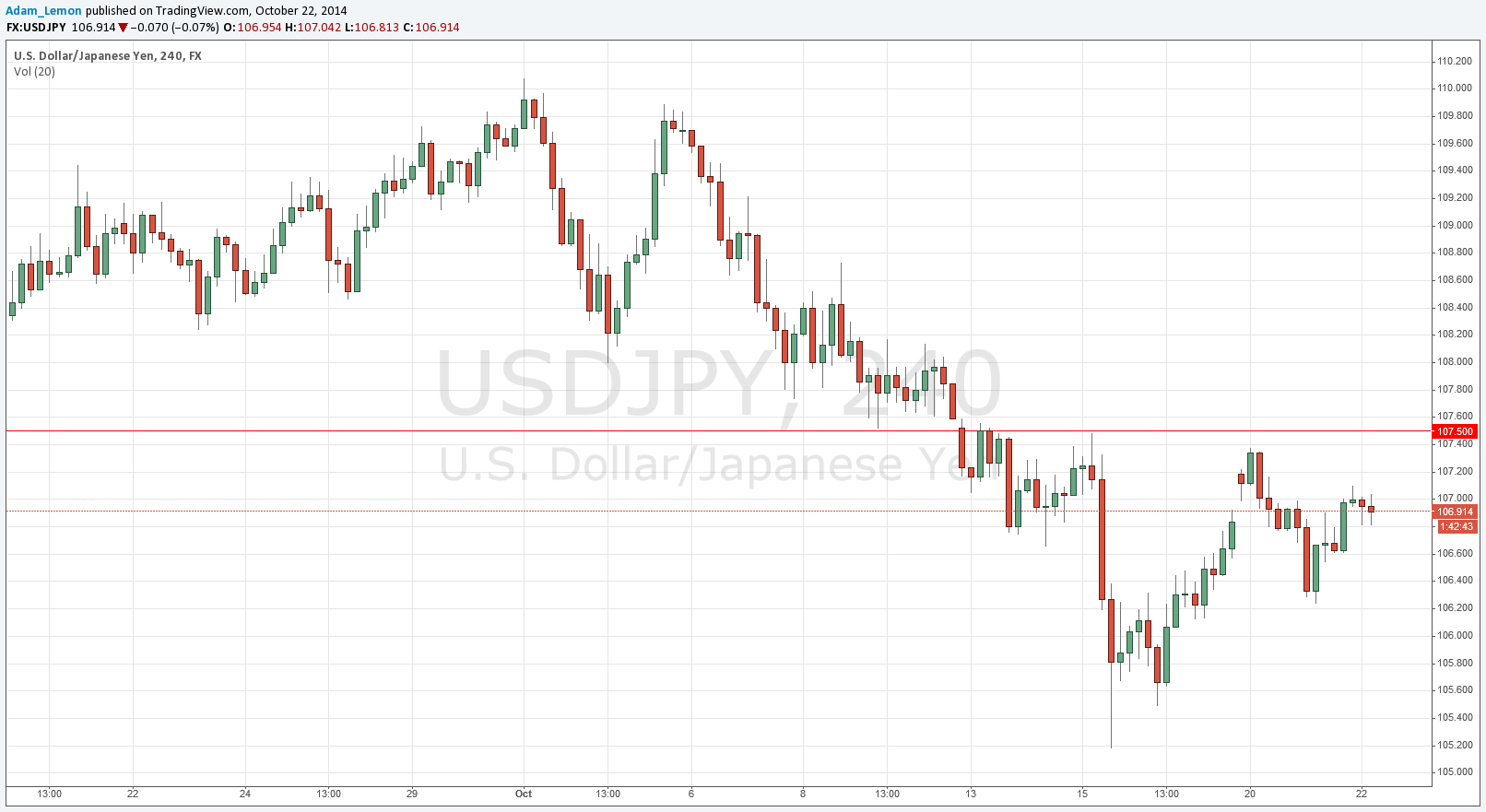

Yesterday’s signal was not triggered as the price did not reach 107.50.

Today’s USD/JPY Signal

Risk 0.75%

Trades only before 5pm New York time or from 8am Tokyo time to 8am London time (Thursday).

Short Trade

Short entry following bearish price action on the H1 time frame after a first touch of 107.50.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

USD/JPY Analysis

The JPY strengthened yesterday and this pair is currently trading close to the low of this week. Last week’s sharp move up following turbulence and the long-term trend suggest that this pair might make a low and then move up sharply from there. If this were to happen somewhere from 105.50 to around 105.00 (which is a key psychological level), I would have more confidence in the bullish bounce producing some momentum.

However there is only one support or resistance level anywhere nearby that looks especially strong and lasting and that is 107.50 which I have been forecasting could produce a good short opportunity if and when the price returns there.

There are no high-impact data releases scheduled today concerning the JPY. Regarding the USD, there will be a release of Core CPI data at 1:30pm London time.